You have read hundreds of articles on how to trade stocks and REITs, how the stock market works, and you are eager to start right away. But before you start, you need a CDS account and a brokerage account. Hence this article is meant to guide you on how to open a CDS account in Malaysia with an app called Bursa Anywhere.

But before we go into the step-by-step guide, let me share with you a few things that you may want to learn if you are new to stock investing.

Update 29 March 2021:

If you plan to register a brokerage account from Malacca Securities, I highly recommend you skip this article and register an account from them directly. The reason is that you will be charged twice the CDS account fees if you register from both Bursa Anywhere and Malacca Securities.

Here is my short article on How to Register A Brokerage Account (MPlus Online) in Malaysia

Disclaimer: I am not a certified financial advisor. Hence the article’s content is based on my own knowledge and experience. I try my best to provide the most accurate information possible but feel free to enlighten me if there is any misleading information provided.

What is Bursa Anywhere App

Bursa Anywhere is a mobile app by Bursa Malaysia to allow investors to check their CDS accounts in one place. In this app, investors now are able to view all their shares in Bursa Malaysia in one place and perform CDS account services such as transferring shares between brokerage accounts.

Another awesome feature Bursa Anywhere has is we are now able to open a CDS account completely online. Days are gone when we have to depend on our brokerage agent to open a CDS account on our behalf.

Some of you might be wondering, is it really new to open a brokerage account in Malaysia online? It can be done easily with Rakuten Trade, right?

Hold your horse first. Keep reading and I’ll explain.

Read More: 3 Stock Investing Apps You Should Install When Invest in Malaysia

CDS Account vs Brokerage Account

A CDS (Central Depository System) account is a depository account that stores all the shares we own. Since Bursa Malaysia is the only market in Malaysia, so it is safe to say that all CDS accounts are maintained by Bursa Malaysia.

A brokerage account (AKA a share trading account) is where we can deposit money and place trades in the stock market. It serves as a platform for investors to trade stocks.

When we buy stocks from the stock market, the broker will help us with the transactions and store the stocks in our CDS account. Hence, we need both a brokerage account and a CDS account for us to trade stocks.

However, there is a way for us to trade stocks without having our own CDS account. It is by registering a nominee account.

Direct Account vs Nominee Account

When we want to open a brokerage account in Malaysia, there are two types of accounts: direct account and nominee account.

Simply said, a direct account is a brokerage account that ties with our own CDS account, while a nominee account is a brokerage account that ties with their CDS account.

With a nominee account, the shares you bought will be under the broker’s name. Hence you don’t need a CDS account when you register a nominee account. Rakuten Trade is the brokerage firm that provides only nominee accounts.

Hence in this guide, I am trying to share how to open a direct CDS account online, NOT a nominee account. Hope you are clear on this.

Pre-requisite for Account Registration

- RM10 for the registration fee (any broker)

- Your IC for photo taking

- A Bank Statement with Your Name & Bank Account Number

Step-by-Step: Open a Brokerage Account with Bursa Anywhere

All necessary information covered? Good. Let’s get started on how to open a brokerage account in Malaysia with Bursa Anywhere.

Download and Install Bursa Anywhere

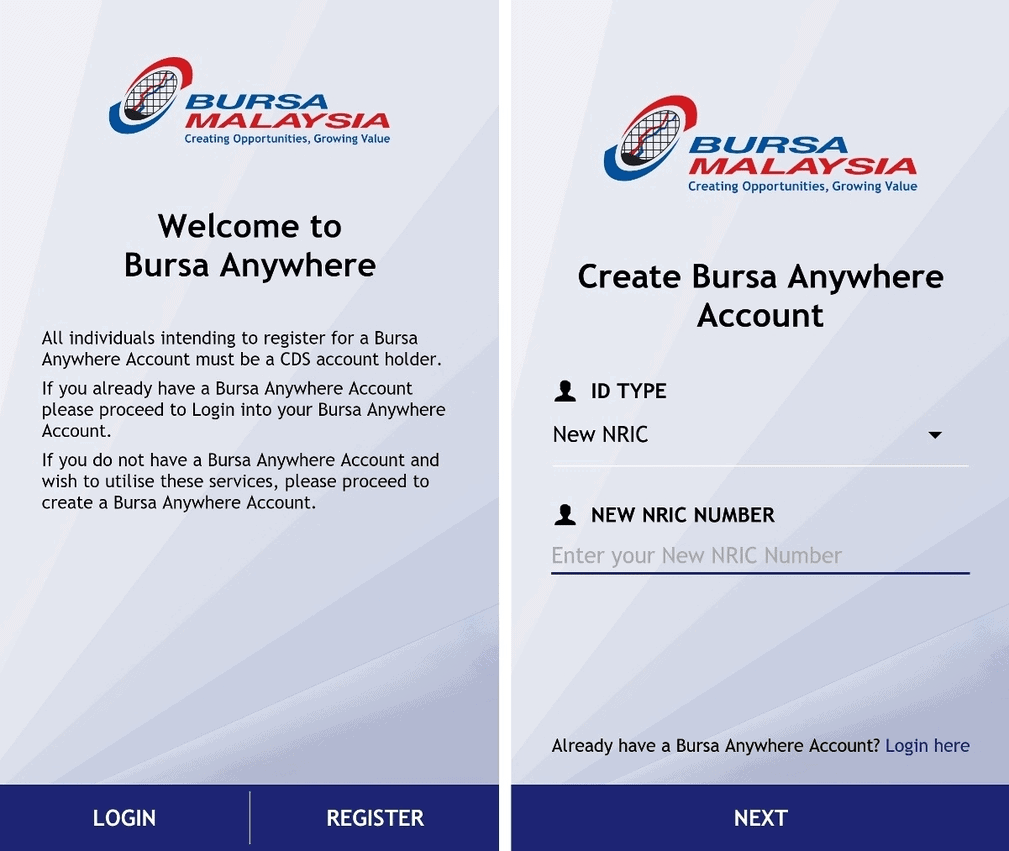

You can download the Bursa Anywhere app either from the Play Store or App Store. Upon the app has been installed, start the app and you will see the page below.

As a first-time user, click “Register” and key in your IC. You will then see a prompt out saying you do not have a CDS Account as shown below.

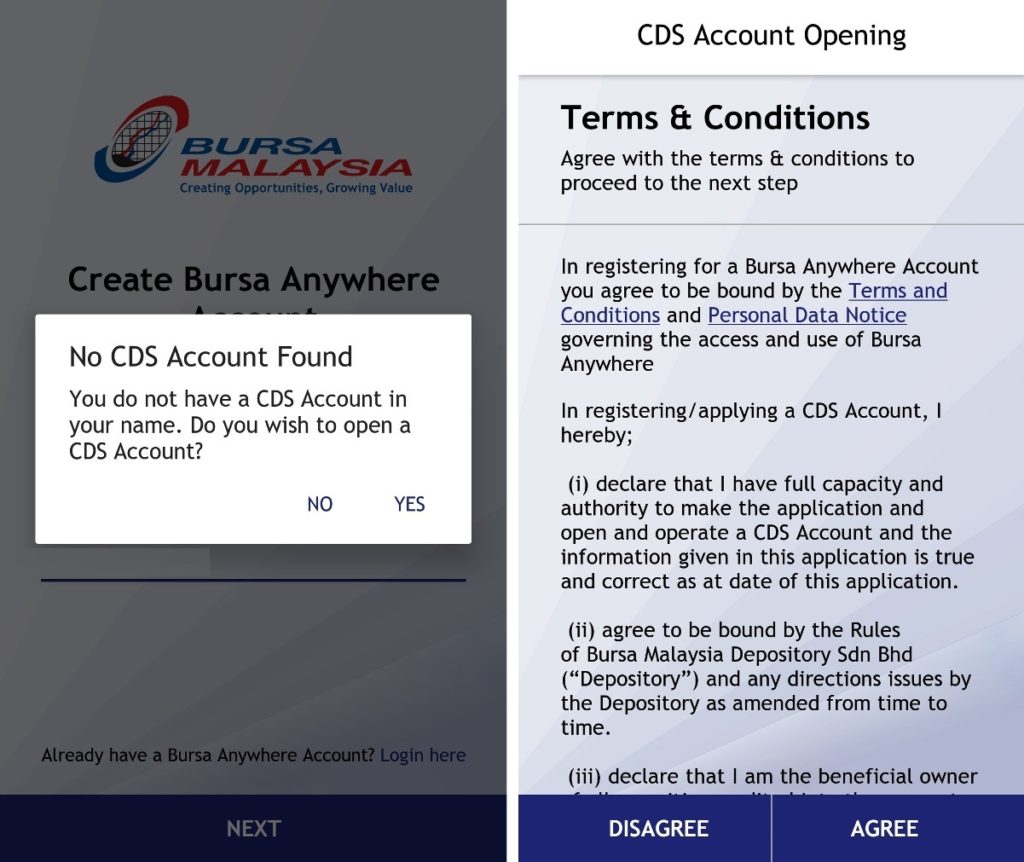

Before guiding you on how to open a brokerage account in Malaysia, we need to register an account for Bursa Anywhere (Bursa Malaysia) first.

Register an Account in Bursa Malaysia

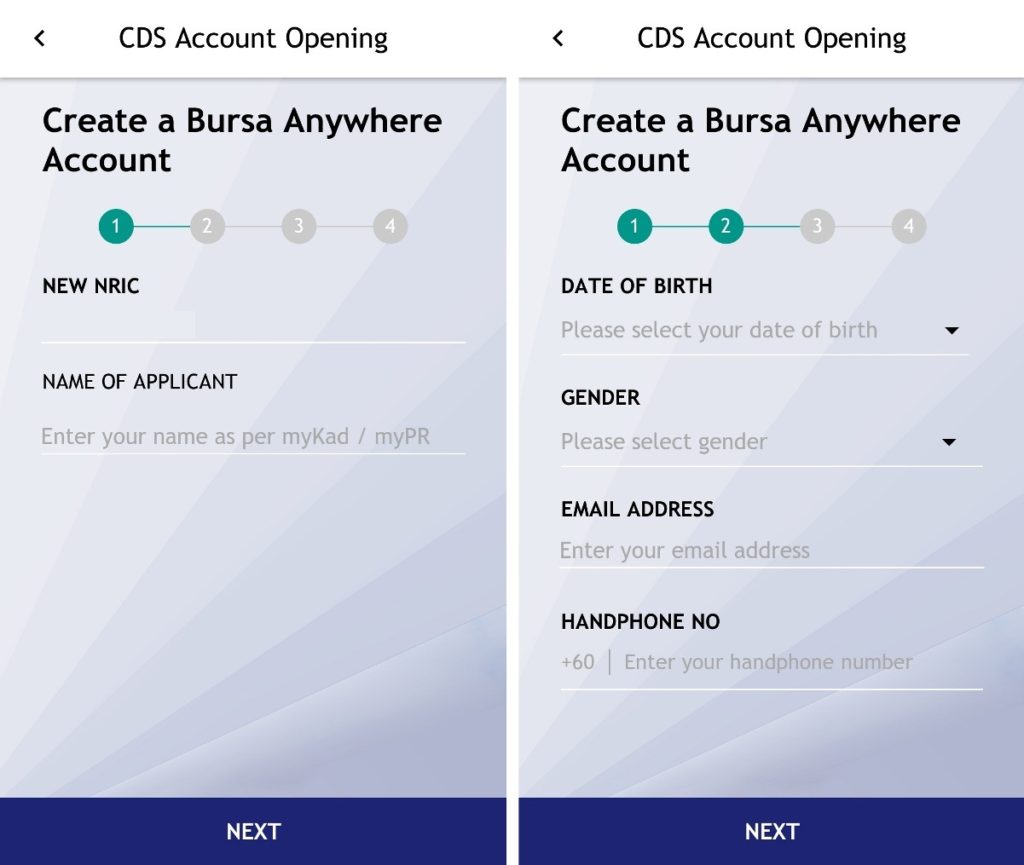

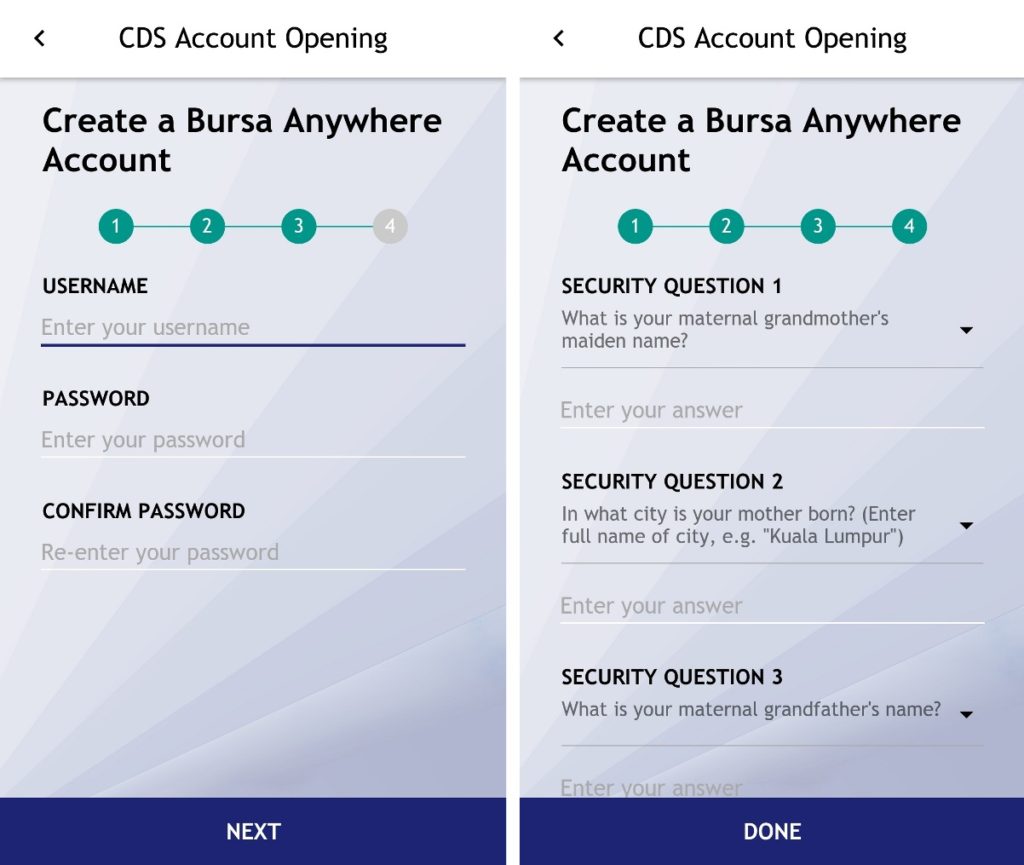

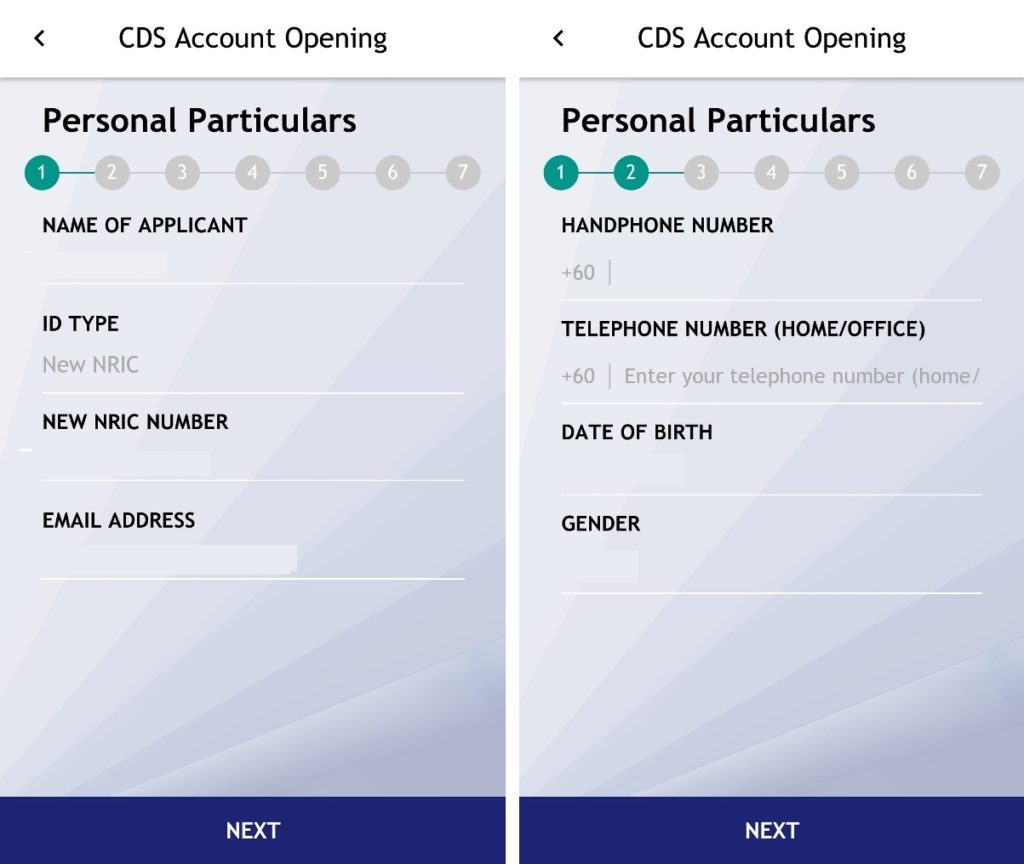

Fill in your name, date of birth, gender, email address, and phone number. After step 2, you will be required to key in an OTP sent to your email address.

After submitted your OTP, you will create your own username, password, and secret FAQs for Bursa Anywhere. Then you need to key in another OTP sent to your phone number.

Register a CDS account

After done with Bursa account registration, now we will be filling in our details for the CDS Account. At the end of the steps, we will only choose our preferred ADA (Authorized Depository Agent), also known as brokerage houses.

Step 1 will have all the info pass down from your Bursa account, and you only need to input a home or office telephone number in step 2.

Complete the info in step 3. Then, you will be filling up the address that is found in your IC, not the current house address you’re staying in now.

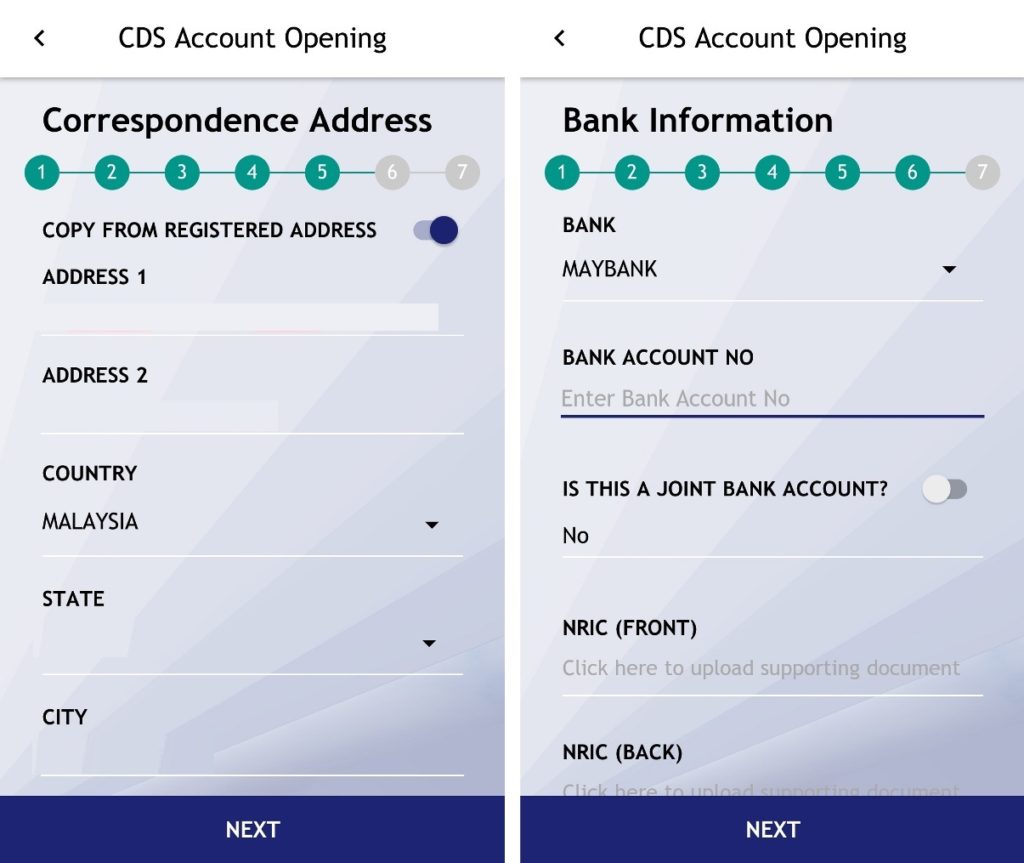

For step 5, enable “Copy from registered address” if you want your Bursa letters delivered to your IC address. Next, you will fill in a bank account that will be used to receive your dividends. Also, this step will lead you to take a photo of your IC front and back.

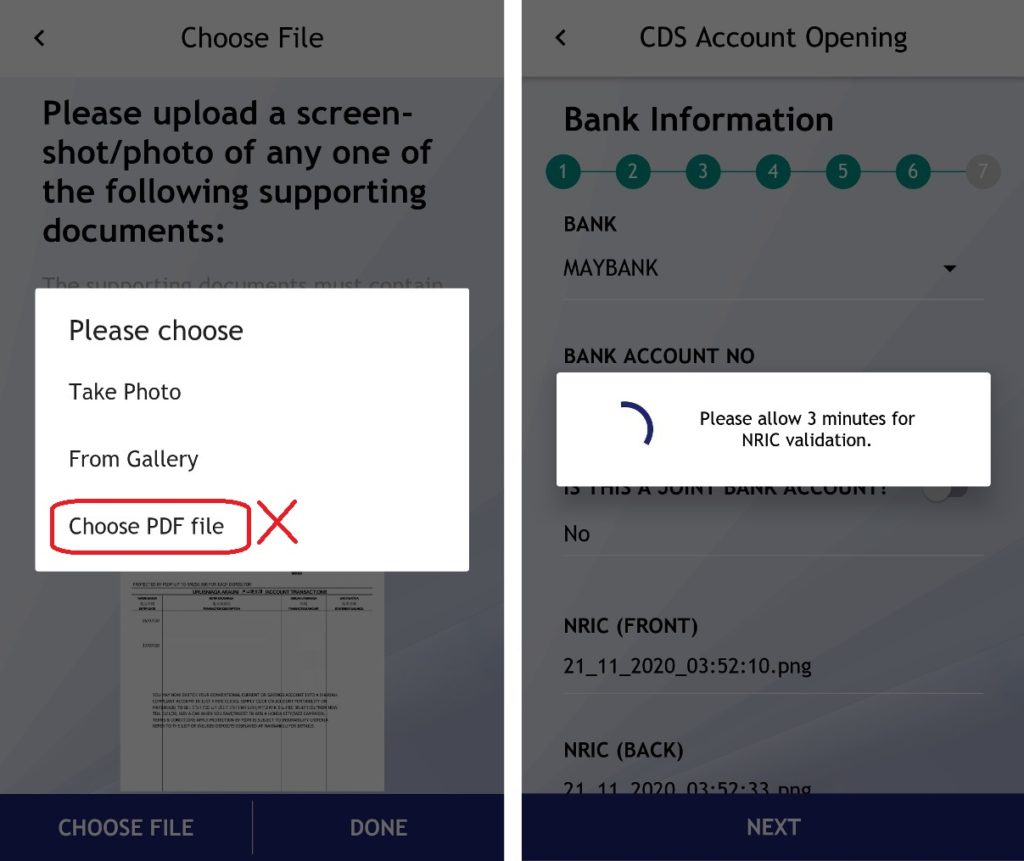

There is an important step here. Upload your bank statement by either taking photo or choosing a photo from your phone gallery.

Do not choose “Choose PDF file” for your bank statement because you will receive this error (as shown below) at the end of your registration. I stuck here for some time before I figure out this is an app issue. Bursa Anywhere does not able to proceed with our registration when a PDF file is uploaded.

When you are done, press “Next” and wait for IC verification.

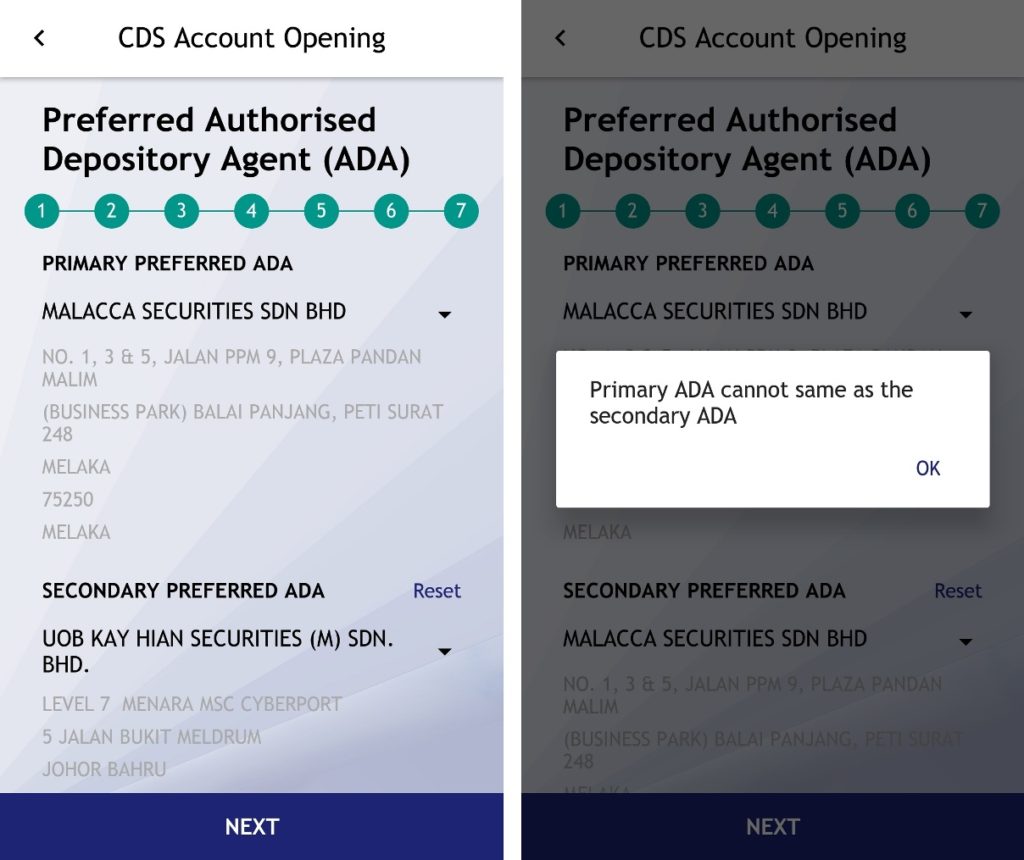

Choose Preferred Brokerage Agents

The last step will be choosing your preferred brokerage account. I tried choosing the same broker for both options but it doesn’t allow us to. So we have to choose at least two different brokerage houses to proceed.

If you have no idea which brokerage account to choose, you can check out iMoney’s page for a great summary of all share brokerages available in Malaysia.

Other than choosing the one with the cheapest brokerage fee, you should also consider choosing one that can buy global stocks if you are interested to invest in overseas.

Before proceeding to payment, you should check if all the information provided is correct.

Pay and Complete Your Registration

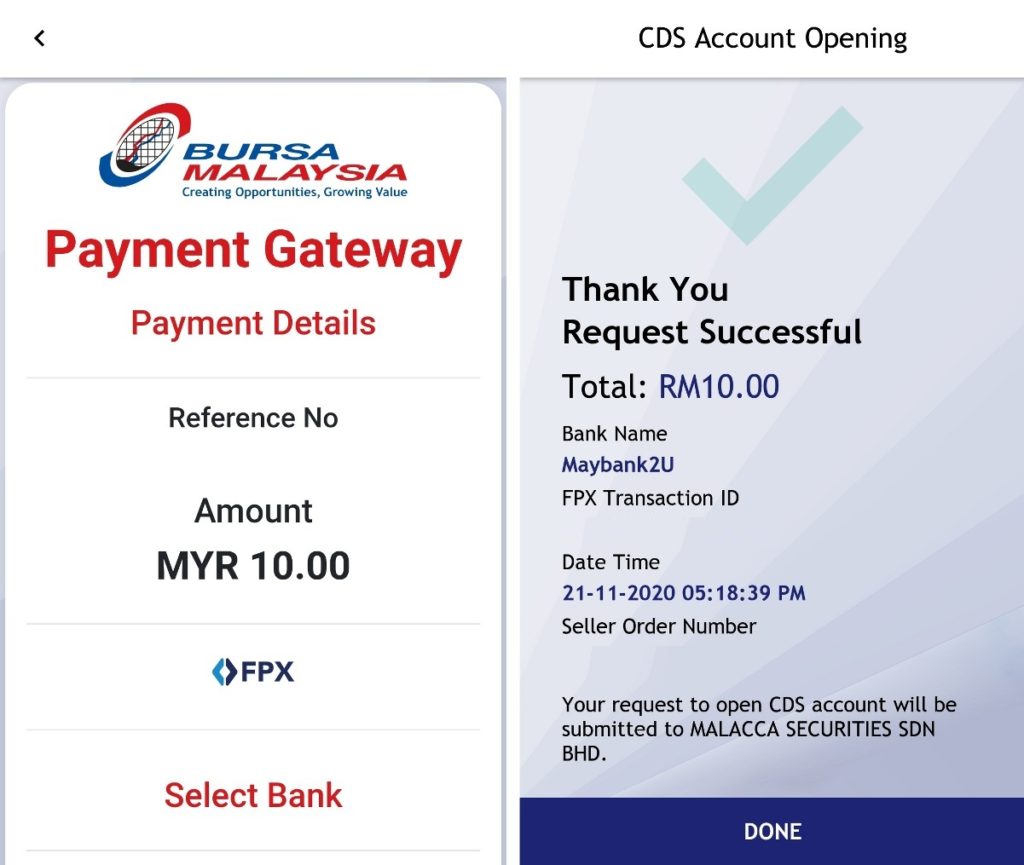

RM10 is the default registration fee when you register a brokerage account, regardless of the agent you choose. You will be paying this fee via FPX using a bank transfer.

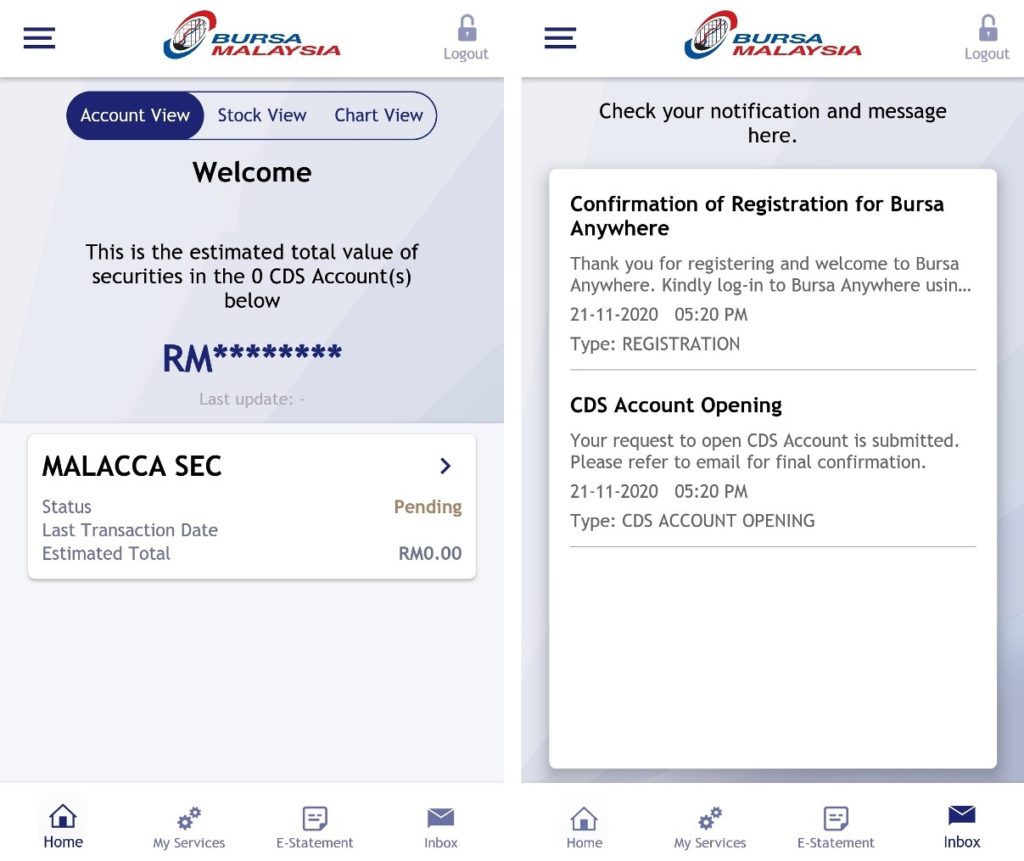

After payment is successful, you can now login to Bursa Anywhere and seeing this page as shown below.

Of course, the brokerage firm needs some time to approve your registration. So you will be seeing “Pending” status when you logged into your Bursa Anywhere account.

Brokers (ADA) Available in Bursa Anywhere

Here is a compilation list of ADA listed in Bursa Anywhere when opening a CDS account:

- Affin Hwang Investment Bank Berhad

- Alliance Investment Bank Berhad

- AmInvestment Bank Berhad

- BIMB Securities Sdn Bhd

- CGS-CIMB Securities Sdn Bhd

- FA Securities Sdn Bhd

- Hong Leong Investment Bank Berhad

- Inter-Pacific Securities Sdn Bhd

- JF Apex Securities Berhad

- KAF Equities Sdn Bhd

- Kenanga Investment Bank Berhad

- Malacca Securities Sdn Bhd

- Maybank Investment Bank Berhad

- Mercury Securities Sdn Bhd

- MIDF Amanah Investment Bank Berhad

- M&A Securities Sdn Bhd

- PM Securities Sdn Bhd

- Public Investment Bank Berhad

- RHB Investment Bank Berhad

- SJ Securities Sdn Bhd

- TA Securities Holdings Berhad

- UOB Kay Hian Securities (M) Sdn Bhd

Note: This list is updated on 22 November 2020.

Summary

There are some bugs in this app when you try to fully use it. But at least we can open a brokerage account in Malaysia without meeting a brokerage agent. So Bursa Malaysia has my applause for this.

If you like this article, then you may like my other articles as well. Feel free to subscribe to my newsletter so you can get the latest update from me when I posted a new article. 🙂

[mc4wp_form id=”236″]

Oh ya, you will also get an exclusive stock dashboard spreadsheet for FREE when you become one of my email subscribers.

If you want to receive more updates from me, feel free to follow my social media below. I would love to connect with you!

Hi Marcus,

Your post has been a tremendous help on the process of opening a CDS account. But I got stuck at the last part, after putting all the required info, and to click SUBMIT, it kept prompting the message “There was an error. Connectivity Error, please try again later.” I had tried for 2 days and its still showing the same error message. May I seek for your advise what I should do now? Thank you in advance.

In your opinion, Which brokerage hse better, UOBKH or M+ online,?

I never use UOBKH before, so I can’t give you my feedback on which one is better.

Hi Marcus,

Will our money deposited into brokerage house like M+ and UOBKH safe in the event like if above brokerage close down? Will we be getting back our deposits?

The money is always in the brokerage account (M+ and UOBKH), not in the CDS account.

CDS account is only for recording the shares we own.

In the event of the brokerage closing down, you have to claim back your cash directly from the brokerage house.

CDS account has nothing to do with it.

Hi Marcus,

Thanks for the great sharing. Is there any chance for me to change the ADA after I got my approval for my CDS Account? Can this be done via the Bursa Anywhere app?

You don’t have to do everything in Bursa Anywhere.

Just refer to your ADA and tell them you already have a CDS account.

They will automatically link your CDS account, given that it is a direct account.

Hi, thank you for this brief explanation about this platform.It was spot on.Keep up the good work

Thanks for visiting my blog and the feedback! 🙂

Hi do you know how to update mobile phone number with Bursa Anywhere?

Hi, in your Bursa Anywhere app, just go to “My Services”, “Update CDS Account Details”.

You can choose “telephone number” and update it.

Thanks Marcus! The application got rejected today. Can I apply using my detail if I am a housewife without any income?

Sure! You can still apply for a CDS account without any income.

Hi Marcus,

Can I open the CDS account using my spouse detail while the dividend account using mine?

Hi Ying Ying, unfortunately no.

The bank account has to be the same name/person as the owner of that CDS account.

Hi Marcus

Great guideline! I already open my CDS account with M+ within an hour.

What should i do next? I realize i cannot register on M+ platform. Perhaps, do i need to wait them to create the account for me?

Thanks

Hi Kamal, thanks!

Yes, you may wait for them to contact you about account creation.

If there’s no news within 2 weeks, then only contact them.

Hi Marcus, firstly thank you for your help in creating this post!

I have recently gotten in touch with a Malacca securities agent and she is guiding me to set up an account. she has mailed me some forms to be filled and I realised she has already pre-empted my account type to the M+ Gold account. I have just asked her about it and yet to receive a reply. I initially just wanted the Silver account. Can you tell me the difference between the silver and gold? Did she choosing the gold account for me was to benefit her sales commission in any way? Should I be weary of this? Sorry too many questions, first time doing this on my own. Really trying to be thorough and not make mistakes that could have been avoided. Thank you again for your time and energy reading this!

Hi Ash, you’re welcome!

From what I read on their website, it seems that the gold account is a contra account, which you can borrow money to invest.

You are probably right about the agent’s intention. I agree that you should insist to opt for the M+ Silver account, so you can only invest with your own money, not borrowed money.

Good luck to you!

Hey Marcus,

I have opened my bursa account and my trading account with ambank and UOB. Just want to know how long will it take for bursa to approve my submission from my trading account. I have submitted my fund for a company on thursday. How long will the process take?

Best regards

Suresh

Hi Suresh,

Trading account approval is up to Ambank and UOB. Bursa only in charge of your CDS account, which usually approved in just less than a week.

To be honest, I have no idea how long it will take Ambank and UOB to approve your trading account.

For M+ Online, it usually takes 2 to 4 weeks.

Hope my reply helps!

Hello! Great helpful article. But I can’t find a solution to the problem I’m facing now.

I registered a CDS account about 30 years ago. Now I want to start trading again. How do I go about doing this? I can’t open a new CDS account via the ‘Bursa Anywhere’ app because it doesn’t prompt me to the new account creation option because I have the old account registered under my IC. So I’m stuck there.

The other option I have is to maybe retrieve my old CDS account with security pin and other information that I have long forgotten. I’m also unsure how to do this and where to look nor are there any guides on this. Can you give me a pointer on this please?

Thanks for your efforts!

Hi Rover, you can directly appraoch one of the brokerage firms, such as Malacca Securities.

If you are interested, you may read this article of mine on how to register one online.

How to Register A Brokerage Account (MPlus Online) in Malaysia

Hi,

I have successfully open my CDS account via Bursa Anywhere, I choose Hong Leong Investment bank as my broker, What should I do next in order to access Hong Leong Bank Trading account ,do I need to manually apply a trading account in Hong Leong Bank?

Hi, you should receive an email or any contact from the Hong Leong brokerage. If you didn’t, then you may need to contact them first.

Hi

Can a foreigner open a Bursa Malaysia account? I’m a Singaporean with bank account in Malaysia. I am concerned about NRIC and address as I do not have an address in Malaysia.

Also, what happens if one day we decides to close the bank account?

Wonder if you are able to advise on this. Thank you

Hi there! It is recommended that you find your preferred broker to open a Malaysian brokerage account. The process will be much easier compared to open a CDS account first from Bursa Anywhere. The broker will help you to register a CDS account for you, which will be more convenient.

Reference: https://www.bursamarketplace.com/anywhere/asset-doc/faq.pdf

Good article. Thanks Marcus. Wondering if you have the answer the question below:

1) I tried to register Bursa Anywhere and put in my new IC number but it’s saying “No CDS Account found” which is odd because I got one through Public Investment Bank–any chance you know how to resolve this?

2) As you mentioned, Mplusonline broker, do you if they charge any fees for receiving cash dividend? PBE is charging up to 5.60 so I’m looking to leave them!

Thanks

1) I’m not sure if you are opening a direct account or a nominee account via Public Investment Bank. You should check with the remisier in charge of your brokerage account.

2) Either M+ Online or other direct account brokers will not charge us if we receive dividends from Malaysian stocks. So you should really check with them. 🙂

Hi Marcus, your blog helped a lot in explaining the processes, and with that, I have completed my CDS account by choosing Hong Leong Bank and Maybank as my ADAs. I submitted a Maybank Savings Account for the Bank Statement file. However, I’d like to ask, would there be a possibility that these ADAs or Bursa Malaysia charge a monthly or annual fee for just having the CDS/Bursa account? Another question, if the ADAs decided to have an appointment with me and I decided not to open an investment account, would that be okay? My sole objective to open a CDS/Bursa account is just to see what does it have in store and learn from it, who knows it could benefit me in the future. I don’t plan to start investing yet. I hope you could enlighten me on those questions. Again, your blog is great and very informative. Hope to hear from you soon, thank you in advance.

Hi Ahmad, thanks for your feedback. I am really glad that my blog can help.

1) As far as I know, there is no monthly or annual fee for any CDS Account or Local Brokerage Account.

2) Yes, it is up to your choice not to open an ADA account.

I’m glad you take it slow. Investing without knowledge is dangerous. So take your time.

Hi Marcus Keong,

If i am unable open CDS account through any ADA listed, how could i escalate to bursa Malaysia?

Regards

Ong

Hi Ong, I have no idea why you couldn’t open one. But you can surely contact them.

Bursa Anywhere: 03-20347090 or email at bursaanywhere@bursamalaysia.com

Contact Source

Hi Marcus, just to let you know, I also face the double charge issue. But Bursa did refund back the RM10 after many weeks, or maybe months later. I only realized when i check on the bank statement.

Oh really? Glad to hear that. Hopefully, I will get back my money too.

Hi, I have registered and get my CDS acc approved. I picked RHB investment and the nearest branch called me and said the person in charge will contact me further for an appointment (I believe for trading account setup). But, after two weeks+, I received no further follow up from them. Any idea?

You can follow up with them for your appointment. Just refer to RHB investment website: http://www.rhbinvest.com/

Hi Marcus,

Thank you for your article. It was very helpful.

Just some feedback from my side that I got the confirmation email from Bursa Anywhere within the same day (10 Mar 2021), and the ADA that I chose is also Malacca Securities. Not sure if you’ve gotten yours.

Yes! I have the email from M+ after a few weeks! I will write another article on how to register a Malacca Securities brokerage account online after we registered our Bursa Anywhere account.

hi i have problem with my registration. I’ve choose M+ as my ADA and then they rejected my application since my account number for my dividen is Maybank. what should i do now. this is the 2nd time i register as the first time i was using RHB also got rejected because of wrong account number. i dont understand why this happened. hopefully you can help.

Is the bank account you use for receiving dividends is the same as the account you paid for the registration fee? It must be the same account, and cannot be a joint account.

I must say it was quite tedious for the online application. I am still waiting for approval for my ADA application as well.

Hi Marcus, may I ask what criteria do I have to consider when choosing an ADA? What about their trading charge?

Usually, I will compare the brokerage fees across different ADA. Next, I will check their reviews via forums (such as Lowyat) in terms of customer service, app features and user experience.

IMHO, M+ and UOB Kay Hian are quite affordable in terms of brokerage fees. HLeBroking is also quite popular (not sure what’s the reason)

HI MARCUS,

did you get feedback on your application for trading account? how long does it took ?

Hi, not yet.

I just resubmit it on 17 Feb. So might need to wait around 2 weeks, which is a typical timeline to open a (direct) brokerage account.

Hello, thank you for writing this very helpful blog! my question is after already been approved of our request to open a CDS account, do I need to go to the ADA office to open the actual brokerage account? what do I need to inform my ADA when opening the account?

Hi Arif. You can email your respective ADA that you already register a CDS account through Bursa Anywhere. They will guide you what to do next.

Hi, I have successfully opened CDS account via the app, but how about opening trading account ? Will the bank contacting me ?

Hi Sulaiman, unfortunately you need to contact the bank that you have opened a CDS account via Bursa Anywhere app. This is a big drawback of this process. There is no integration between Bursa Malaysia and brokerage firms.

I will update my article now so everyone will know this.