Read Time: 4 minutes

I was never interested in property investing.

- Study locations of the properties

- Survey the property on site

- Apply loans to buy them

I don’t mean to say property investing is not a good investment, it is just not my cup of tea.

But when it comes to stock investing, it excites me to

- Study business behind the stocks

- Survey new stocks & IPOs

- Apply dollar cost averaging

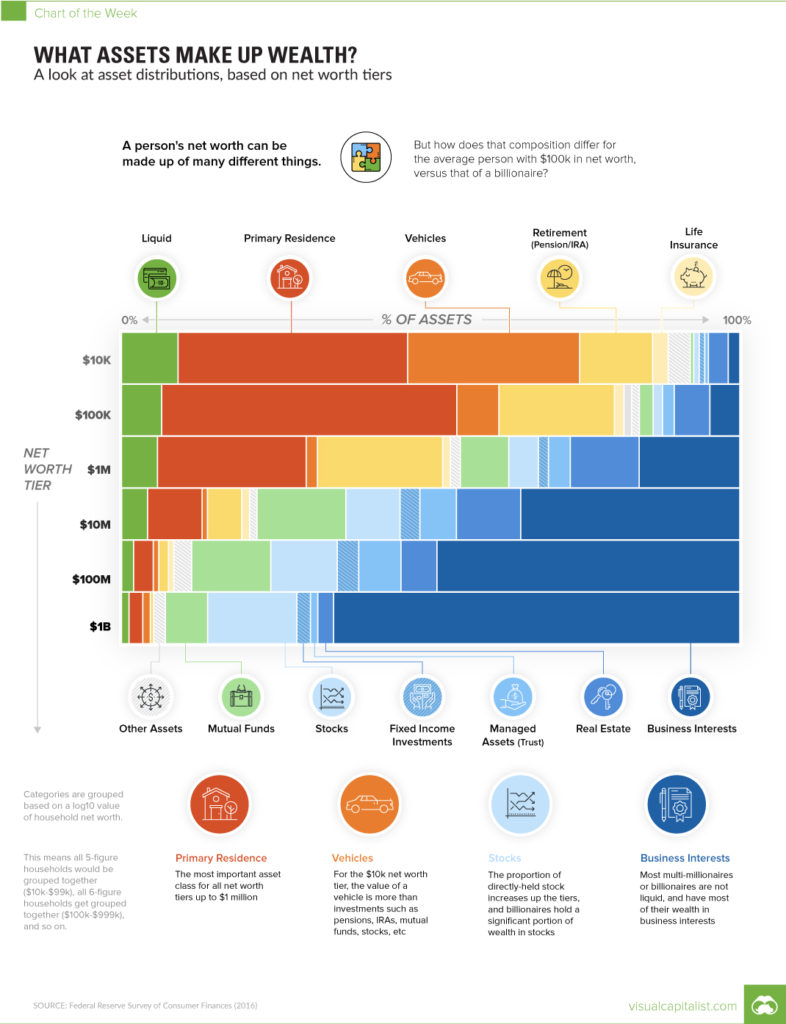

Here’s an infographic showing the assets that are owned by individuals with different levels of wealth. Interestingly, the wealthier people own more stocks than property (real estate).

Source: Visual Capitalist

But is stock really better than property?

In this week’s newsletter, let us compare between stock and property investing.

Disclaimer: Any investment mentioned below is not investment advice. They’re for educational purposes. Please do your own due diligence before investing in any asset.

Reasons to Invest in Stocks

1) Lower Capital to Start

“Investing is for rich people” no longer applies.

With the rise of robo-advisors and fractional shares, it is getting more affordable to invest in stocks as low as RM100.

But to invest in properties, they cost at least RM100k and finding a property with less than RM100k is like catching a rare Pokemon.

And this leads to my second point.

2) No Loan Required

There is no way to invest in a property without getting a loan. Unless you have a daddy that allows you to buy it in cash. (JK, maybe you are the rich daddy/mommy)

Fortunately, you don’t need any loans to start investing in stocks. This allows you to have less debts or debt-free, which is great for financial stability.

3) Better Diversification

With ETFs, stock investors can now easily diversify their investments. The most popular way is to invest in index funds ETFs.

Other than ETFs, REITs (a type of stock that invest in real estate) are also a good choice for diversification.

For example, AXREIT is a Malaysian REIT that invested in multiple offices and warehouses. When you buy this REIT, you are indirectly investing in multiple properties.

Whereas for property investing, most people can only afford to invest in 1 or 2 properties. If one of them fails, it will significantly impact your investment.

4) High Liquidity

Liquidity means the efficiency to convert an asset to cash. Stocks are considered as a highly liquid asset as you can sell them off anytime during the (stock) market opens.

Assets with high liquidity give us the flexibility to change our asset allocation.

To sell a property, it will take you several documents and weeks to convert the asset to cash.

Reasons Not to Invest in Stocks

1) High Volatility

When an asset has high liquidity, it is easier for investors to buy and sell anytime. This will cause the price of the assets to fluctuate frequently.

Stock investors may have an unrealized gain of 5% today, and it turns into -7% losses tomorrow. This is normal yet scary for new investors.

While for property investment, price volatility will be less compared to stocks.

2) Non-tangible asset

There is one reason why our elders love property investing. It’s because we can see, touch and feel the assets we own.

If you buy a stock, you only see it in your brokerage app. There used to be stock certificates for every stock you purchase, but now everything is digitalized.

You have no choice but to trust the system that manages your assets. This leads to the third point.

3) Prone to Scams

As stock investment is made via apps and the web, scammers take this as their advantage to scam innocent investors.

They will use all kinds of tactics such as unrealistic high returns or fake reviews to attract investors to deposit money into their unregulated platform.

It’s normal for new investors to try everything new to them, but this becomes a loophole for scammers to exploit.

Meanwhile, scams on property investment are much lesser. Not surprised, as a physical asset is expected during the transaction of property investment.

Verdict

Above table shows the summary of the pros and cons for stock and property investing.

Being a stock investor, I won’t deny that stock investing has its own risks.

- Stock price is highly volatile

- Non-tangible assets

- Prone to scams

To counter the risks of stock investing, I have built some habits, such as reducing my frequency of looking at the share prices and choosing brokers that are regulated by Malaysian SC.

Second point is not an issue to me, as I am comfortable doing my investment within my devices.

One thing I did not mention above is stocks may give higher returns than properties due to their high volatility attribute. Alas, it’s a double-edged sword, hence I did not include it above.

Aside from the pros and cons, both investments are able to provide us with passive incomes and capital growth for our money. It will be worth it to invest in either one of them, or both if you want.

That’s all for this week, my friend!

What did you think of today’s newsletter? Comment below and let me know what you’d like to see more of.

Talk with you again next week.

Your Money Buddy,

Marcus

Whenever you’re ready, there are 2 ways I can help you:

1) Book a 1-to-1 Call Session with me if you want to pick my brain, either money management or any topic you would like to learn from me.

2) If you’re not sure which platform to invest your money, here are 3 platforms that I personally use:

→ Rakuten Trade – Where I invest in US index fund ETFs. Get RM30 worth of RT points if you register & unlock foreign trading with my referral link.

→ Wahed Invest – Where I invest in Shariah-compliant US ETF. Get free RM10 if you register a new account with my referral code “markeo1”

→ Versa – Where I invest my emergency fund with 4% return (until Aug 2023). Get free RM10 if you register a new account with my referral code “AL9JZJ9H”