In order to let the compound interest works for us and makes our dividend snowball (like the panda), we need to allocate our dividend to buy more shares. As I was learning more about reinvesting dividends, I stumbled upon a thing called a dividend reinvestment plan. We usually find it abbreviated as DRIP or DRP in Malaysia.

In simple words, a dividend reinvestment plan is a corporate action that allows investors to use the dividend distributed by the company to buy the company newly issued shares. By choosing this option, investors get to enjoy a few benefits while having their dividend reinvested.

Here are the 6 things that I would like to share about DRP:

DRP Provides Lower Share Price

When a company declared dividends with the Dividend Reinvestment Plan, the issue price is usually lower than the current share price. It means that we get to use our dividend to buy the company shares at a lower price.

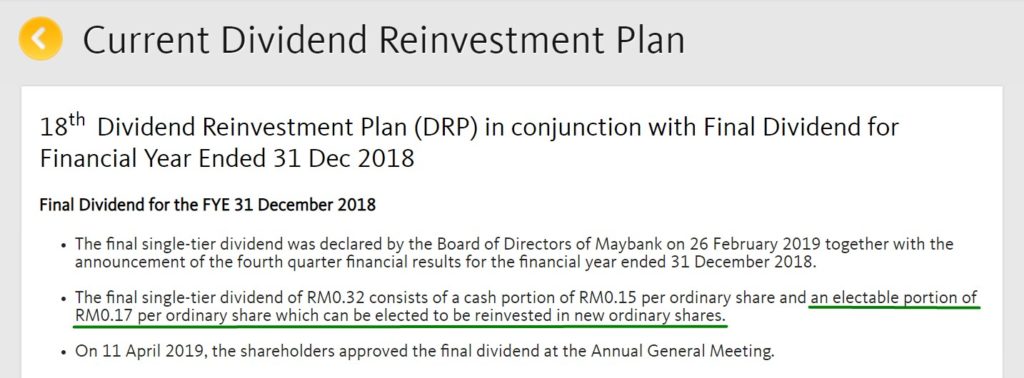

Let us look at the Maybank’s last DRP in 2019:

If we refer to the share price on 23 April 2019 after the market closed, it is around RM9.16. If we look at the issue price by DRP, which is RM8 per new share, it is 12.7% lower than the original share price.

From the above situation, it is definitely a no-brainer to apply for DRP when the dividend is declared. But then, we need to notice if the company share price is declining below the issued price. If that happens, then it will be meaningless to apply for DRP.

A Commission-Free Way to Reinvest Dividend

Another benefit of DRP is it does not incur any brokerage fees. This is because DRP allows us to obtain our “fair shares” from the company directly without any transaction with our broker.

However, we should take note that there is a small fee for the DRP application. The fees are made up of RM10 stamp duty (and RM3 handling fee if we apply online). Compared with the brokerage fees, these fees are usually lower and even negligible for investors with a huge amount of shares. So it is surely worth the application for DRP.

Having Odd Lots After DRP

Throughout the investing journey, there are some people who do not recommend us to apply for the DRP. One reason is that we will end up having odd lots after DRP is executed. Odd lots are referring to the lots that are not in a hundred share units, eg. 56 units.

In Bursa Malaysia, the share transactions are usually in lots, where one lot is equivalent to 100 units share. If we purchase shares in less than 100 units, for instance, 56 units, then we call that an odd lot. It is so odd that we find it difficult to buy or sell in the stock market. In other words, odd lots are usually not easily converted to cash.

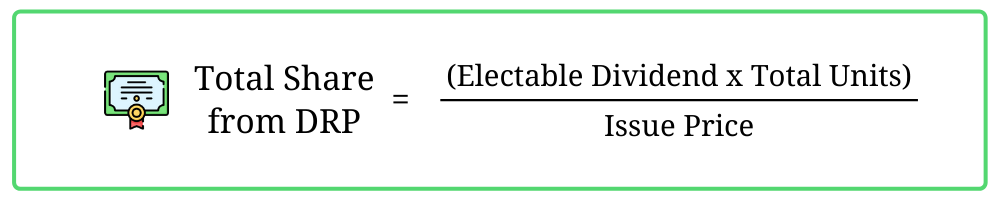

Let us use Maybank’s last DRP as an example again. Now we own 20 lots (2,000 units) of Maybank shares when the dividends are announced. From the announcement statement, the electable dividend (which convertible to new shares) is RM0.17 per share, and the new issue share price is RM8.

By filling up the highlighted values into the formula above, we get 42.5 units of shares. Please note that there will be no fractional share issued. Therefore we will have an odd lot of 42 units issued to us after DRP, with a remaining RM304 dividend in cash.

After DRP takes effect, we will end up having 2,042 units of Maybank share. This equivalent to 20 lots and an odd lot of 42 units. Hence it is logical for investors not to opt for the DRP, so they wouldn’t have this odd lot.

Then again, if we plan to invest in this company for the long term, then having odd lots should not be an issue for us.

DRP Causes Dilution of Shares

When Dividend Reinvestment Plan takes effect, there will be an increase in the share number of the company. Naturally, this action will cause a share dilution.

What is share dilution? You asked.

Imagine if we want to make a cup of Sunkist orange juice. Plain water is the number of shares, while the Sunkist orange concentrate is the company earnings. With the right amount of orange concentrate (earnings) and plain water (shares), the orange juice will taste just sweet (valuable). But when we add more plain water (more shares) into it, the orange juice will become a little diluted or even tasteless.

In the stock market context, the increase in share number will reduce the earning per share (EPS). As a result, the company needs to generate higher earnings to stimulate its share price.

Let us take a look at the real-life examples: Maybank versus Public Bank. Did you wonder why Maybank is cheaper than Public Bank? If you guess that Maybank has a higher number of shares than Public Bank, then you are correct.

Even though Maybank earns a higher revenue and profit than Public Bank, Public Bank has higher earnings per share (EPS) than Maybank. Hence a share of Public Bank is more valuable than a share in Maybank.

Share dilution can be a disadvantage if we are looking for capital gain in a share. But if the company has stable and growing revenues and earnings, then it shouldn’t be a concern.

Not Every Company Provides DRP

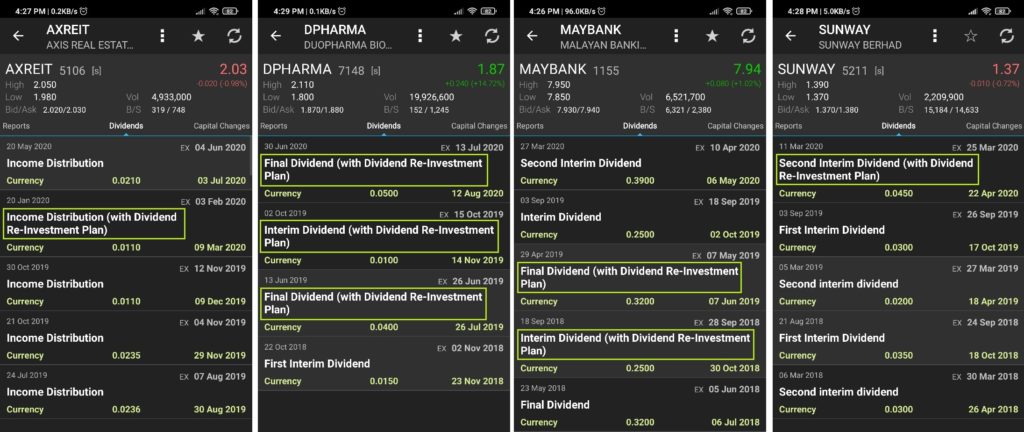

In Bursa Malaysia, there is only a handful of companies that provide a Dividend Reinvestment Plan. Here are a few companies that I found from KLSE Screener which provide DRP:

- Axis REIT

- Duopharma Biotech Berhad

- Maybank Berhad

- Manulife Holding Berhad

- Sunway Berhad

- UOA Development Berhad

Even if one company has a history of DRP, not every dividend distribution from the company has a Dividend Reinvestment Plan. It is totally up to the company to decide if it wants to provide this plan for the next dividend.

In overview, it seems that DRP is still not a popular approach in the companies in Malaysia, yet. I really hope to see more Malaysian companies choose to provide DRP to investors in the future.

We Can Now Apply DRP Online

In the old days, we need to visit the bank and fill up the application form for DRP. Because of the hassle, it is a huge turn-off for many investors to apply for DRP. In fact, not just DRP, every corporate action still requires investors to submit an application form to the bank in person.

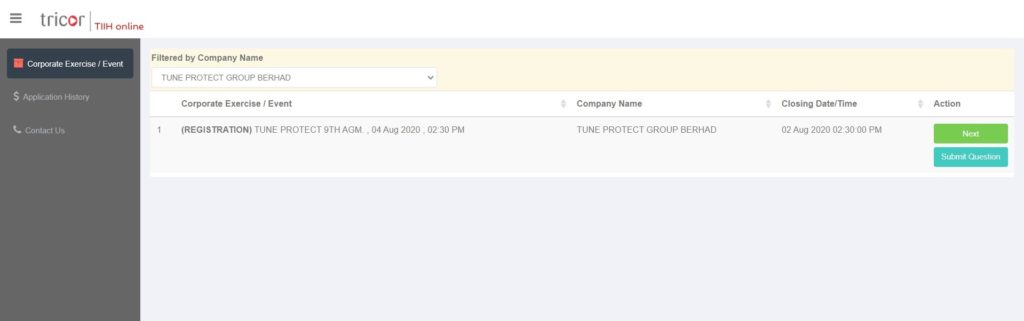

But now I read from Dividend Magic that we can finally apply DRP online through Tricor. Since I do not have any stock that I can try for DRP, so I could not provide my own experience in using the website. But I did sign up in Tricor and check out several corporate actions available there.

I cannot find any company that offer DRP, so I just simply take a screenshot. The Tricor page seems pretty easy to navigate for me. Yay for don’t need to go to the bank anymore!

Summary

In the nutshell, Dividend Reinvestment Plan is the best friend for long term investors (like me). If you don’t plan to invest in a stock for the long term, then it will seem like a bad idea.

Here to summarize my points from the article above:

Advantages of DRP:

1) Reinvest our dividend with a lower share price

2) No Brokerage Fees Needed (Only RM13 for stamp duty & handling fees)

Disadvantages of DRP:

1) Having odd lots which hard to liquidate

2) Share dilution for the company

Notes Worth Taking for DRP (in Malaysia)

1) Very few companies have DRP

2) We can now apply DRP online via Tricor

If you have any questions about DRP, feel free to ask in the comment section below. I will try my best to answer. 🙂

Blog Update & Social Media

If you like this article, then you may like my other articles as well. If that so, feel free to subscribe to my newsletter so you can get the latest update from me when I posted a new article. 🙂

[mc4wp_form id=”236″]

Also, you can also get my new blog post updates by following my social media below. Don’t be shy and feel free to interact with me as well. See you there!

Hi,

CAn I ask how do I find companies that actively provide DRP option?

There is no simple way to do it. Personally, I just scroll through the Entitlements > Upcoming Dividends in the KLSE Screener app to find dividends that provide DRP option.

Very useful information, thank you for sharing 😀

You’re most welcome! Glad it can help you! 🙂