When you are opening a brokerage account for stock investing, you may find that there are two types of accounts: Direct Account and Nominee Account. Like you, I was puzzled when I want to open my first brokerage account. Which one should I choose and what are the differences between these two types of accounts?

I started my investment journey with a nominee account (Rakuten Trade). But later this year I decided to switch into a direct account (Malacca Securities) after I found out their differences.

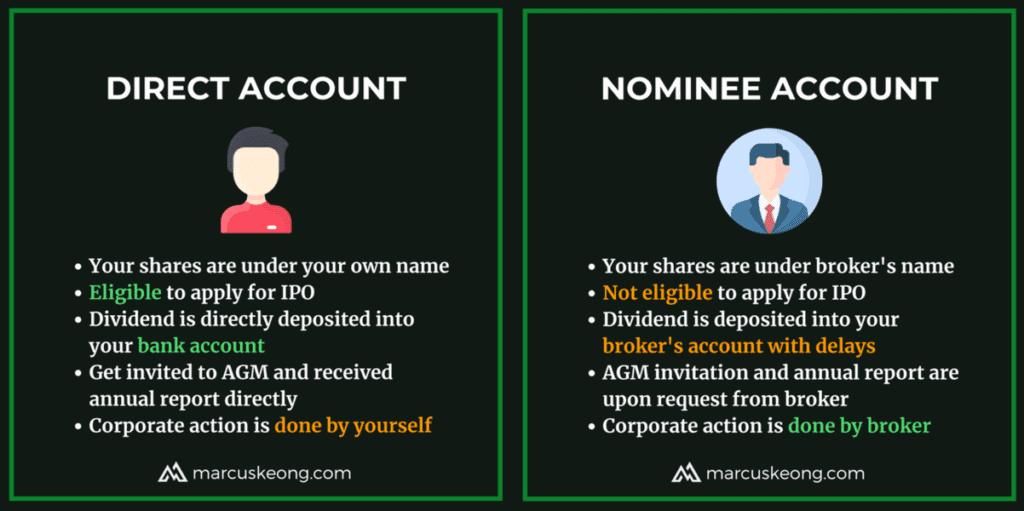

In this article, I will share the differences between a direct account and a nominee account. Let’s get started

The Ownership of Your Shares

The biggest difference of these two type of accounts, is the share ownership. With a direct account, the shares you bought are under your own name.

For nominee accounts, the broker or another party acts as your nominee for the stocks you bought. In other words, your stocks are registered under the nominee’s name, not yours.

Let say unexpected event happened and the broker goes bust. What happen to the shares you bought from them? With a direct account, you can have a peace of mind as all shares are safely stored in your CDS account.

For a nominee account, you will need to retrieve your shares from the nominee’s CDS account. The process may be a bit complicated and takes time. But usually you will still secure back your shares if the nominee is one of the reputable securities firms.

Dividend Payment

This is another reason why I choose a direct account. As I was using Rakuten Trade at my initial stage of investing, I was always anxious on when will I receive my dividend.

If we have a direct account, there will be no delay issue as we will get the dividend paid on the payment date. This payment is usually made directly into our bank account.

But for nominee account, we will receive it later than the payment date. It’s because the stocks we bought are not under our name, hence the dividend is paid to the nominee. Our nominee (broker) will then transfer the dividend into our brokerage account, which usually delayed by 3-5 business days.

IPO (Initial Public Offering)

For your information, IPO is a process where a company lists its shares in public, which is the stock market. So right before the company shares are publicly listed, retail investors like us can apply for IPO and buy the shares with IPO prices.

If you have a direct account, you are eligible to apply for IPO shares. It means you get to buy the IPO share prices before it starts to fluctuate when it is publicly listed in the stock market. Whereas you are not eligible to apply for an IPO if you are using a nominee account.

AGM Invitation & Annual Report

With a direct account, you will automatically receive AGM (Annual General Meeting) invitation and annual report right into your registered mailbox.

Well, you can receive those as well with a nominee account, but with an additional step. You need to make a request with your broker (usually by writing an email) in order to attend the AGM of the shares you bought. The same goes for the annual report.

Company’s Corporate Actions

What the heck is a corporate action?

A corporate action taken by the company will affect the securities (shares) listed in the market. It can be a new acquisition, company name change, stock split, merging, or even bankruptcy.

Basically, corporate actions can be either mandatory or voluntary. In this context, we are referring to the voluntary corporate actions such as dividend reinvestment plan or right issue.

Let say we invested in Maybank and recently they just announced a dividend distribution with an option of a dividend reinvestment plan (DRP). With a nominee account, your broker will help you settle the application.

However with a direct account, you need to apply for DRP all on your own. Fortunately, now we can apply for a DRP in Tricor online, unlike the old days when we need to go to the banks to fill in forms.

Brokerage Fees

There were the days when nominee accounts offer a very competitive brokerage fees to investors. Nowadays, we have some brokerage firms with direct accounts that offer low brokerage fees such as Malacca Securities and UOB Kay Hian.

The fee is no doubt an important factor for many investors when choosing a brokerage account. However, for the comparison between direct and nominee accounts, the brokerage fees seem to be comparable now.

Verdict

If you skip the whole article and jump straight here looking for a summary, I’m a bit disappointed. If you’re not, here is the summary of the whole article:

Choose a direct account if you

- would like to apply for IPOs

- prefer to have the shares under your name.

- receive dividends directly into your bank accounts.

- want to receive AGM invitation and letter directly from your mailbox.

Else, you may choose a nominee account if you

- need a shorter time of account registration.

- want features that direct account brokers don’t have.

- prefer the broker to help you settle those voluntary corporate actions.

- don’t mind the dividend payment is late by 3-5 business days.

For brokerage fees, customer services, and features wise, these depend on the brokers themselves, not the type of accounts.

Personally, I prefer to have a direct account so that all the shares I bought are under my name. Moreover, my dividend is paid to me faster than having a nominee account.

I hope this short article helps you to understand the differences between direct and nominee accounts.

Blog Update & Social Media

If you like this article, then you may like my other articles as well. Feel free to subscribe to my newsletter so you can get the latest update from me when I posted a new article. 🙂

[mc4wp_form id=”236″]

Also, you can also get my new blog post updates by following my social media below. Don’t be shy and feel free to interact with me as well. See you there!

Hi, can I know whether we can have both direct and nominee accounts (from different brokers) at the same time? ie. Maybank and rakuten

Hi Amy, yes you can.

In fact, you can have multiple direct accounts under the same CDS account.

Hi, Marcus.

Love your article.

May I know are TD Ameritrade or WeBull direct account for US stock?

Thanks in advance.

You article on Direct vs nominee account is extremely useful and easy understandable.

I live in Luxembourg how can I open a direct account?

Hi, as long as you have Malaysian IC, you can try register MPlus online.

hi Marcus, do you know how to transfer stock from nominee account (maybank) to direct account (CIMB)?

Hi, I have no idea. You may ask Maybank customer service for that.

FYI, you can only transfer Malaysian stocks to your direct account.

Thanks now i know what account i have

You’re welcome!

Love your articles! I haven’t start investing in stocks but trying to equip myself before starting. Keep up the excellent writing.

Hi Nadia. Thanks for your compliment. You’re doing good there. It is best to take time and educate ourselves before we jump into the market. Take care!