Read Time: 3 minutes

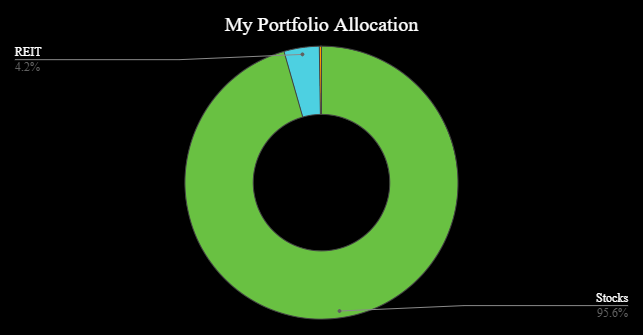

95.6% of my portfolio is in stocks, 4.2% in REITs, 0.2% in cash

More than 90% of my total investments are in stocks.

There are other assets to invest in such as properties, gold, crypto, or bonds. But I am biased toward stocks and believe that they are the best wealth-building tool.

Why?

In today’s newsletter, let me share the reasons why I invested most of my money in stocks.

#1 Assets That Create Value

What does it mean by creating value?

No, this value is not referring to your asset value that appreciate. I am referring to values that are given to society, the economy, and the world.

Source: Pexel

Behind every stock is a company that runs a business. A company grows its revenue and profit by producing goods and/or services to others.

These goods and services are the values provided by businesses, and we’re using them without realizing them. The phones you’re using to read this newsletter, the Internet access you have, and the car you are driving.

When you buy assets that have the ability to produce value, the assets you own will naturally become more valuable!

#2 Business Ownership

We often hear this sentence, “If you want to be rich, start your own business”.

But let’s be real. Not everyone has the skills and talents to start a business.

But everyone can own a business without starting a business. How?

You’ve guessed it right!

It is by buying stocks and owning a tiny piece of a business.

When the business goes well and expands, your money value expands along with it too!

That feeling of seeing the company you own become more successful while growing your money, is super satisfying!

#3 Easy Accessibility

Thanks to the Internet, it is getting easier for anyone to buy stock.

All we need are

- A smartphone (that can download apps)

- Internet

- Money

Just download a brokerage app or robo-advisor app, register an account, deposit money and you can start buying stocks.

There is nothing more convenient than being able to buy stocks while lying on your sofa.

#4 No Loan Required

Unlike real estate, we don’t have to borrow money just to invest in stocks.

“What’s the minimum we need to invest in stocks?”

Thanks for asking that question.

Answer: You can invest in stocks with only RM100.

Even if you’re a low-income earner, you can invest in stocks as long as you are able to save RM100.

Therefore, there should be no reason for one not to invest yet.

All you need is a little saving, some basic knowledge, and the courage to take the first step.

#5 High Liquidity

Thanks to the online stock trading system we have today, every stock investor can now easily buy and sell stocks with just a few taps on the phone.

Due to this nature, stocks are highly liquid.

In other words, it means we can easily sell stocks into cash within a few days.

If you were trying to sell a property, it will not take you at least a few weeks or months to sell your property into cash. We haven’t even started talking about the processing fees involved in selling a property.

Related article: Stock vs Property Investing: The Pros & Cons

In Summary

Let us recap the 5 reasons why I invest most of my money in stocks:

- Assets that create values

- Business ownership

- Easy accessibility

- No loan required

- High liquidity

Don’t get me wrong. I write this not to convince you that stocks are better than other assets. These are just my own reasons why I invest in stocks.

At the end of the day, we all have our own preferences in investments. It is always better to invest in assets that we understand and are comfortable with.

But if you ask me which asset type is the best to build wealth, you should know the answer now.

Reference Article: KC Lau

That’s all for this week, my friend!

Talk with you again next week.

Your Money Buddy,

Marcus

Whenever you’re ready, there are 2 ways I can help you:

1) Book a 1-to-1 Call Session with me to pick my brain, whether it is about investing, money management, or any topic you’re interested to learn

2) If you’re not sure which platform to invest your money, here are 3 platforms that I personally use:

→ Rakuten Trade – Where I invest in US index fund ETFs. Get RM30 worth of RT points if you register & unlock foreign trading with my referral link.

→ Wahed Invest – Where I invest in Shariah-compliant US ETF. Get free RM10 if you register a new account with my referral code “markeo1”

→ Versa – Where I invest my emergency fund for a 4.3% return (up to RM30k). Get free RM10 if you register a new account with my referral code “AL9JZJ9H”