Read Time: 4 minutes

“Stock investing is for rich people”. True or false?

It may make sense for poor people. But in general, not-so-rich people can now easily invest in stocks with little money.

With increasing platforms for stock investment, it is possible for us to invest in stocks with little money.

In this week’s newsletter, let’s explore how we can invest in stocks with just RM100.

Why Stock Investing Used To Be Expensive

From my observation, there’s a reason why our parents’ generation said “Stock investing is for rich people”.

- Back in 2003 or earlier, the minimum trading unit in Bursa Malaysia was 1000 units.

- The ETF was yet to be well known in Malaysia, hence investors need to invest in a few companies for diversification.

- There is no online brokerage platform, investors had to call broker agents to buy stocks for them with fees.

Imagine a stock investor 30 years ago, who planned to invest in 5 different companies with RM1 per share unit, buying 1 lot of each company will cost at least RM5,000 (RM1 x 1000 x 5). And this amount is not including agent and brokerage fees yet.

Indeed, investing in stocks was expensive back then.

But today, many things have changed.

- 1 board lot in Bursa Malaysia equals 100 units.

- There are many online brokerage accounts available, no agent is needed.

- ETF enables stock investors to diversify their investments with minimal costs.

- Now Malaysians can easily invest in US stocks with fractional shares (0.01 units).

This opens up a big door for new investors to start their stock investing journey. We can “feel the water” first with little money before deciding if stock investing suits us.

Before Investing Your RM100 into Stocks

If you only have RM100 to invest, there is a possibility that you are someone who

- Don’t understand the difference between short-term trading and long-term investing

- Never heard of risk tolerance & diversified portfolios

- Don’t know anything about stock investment

If you don’t match the descriptions above, you can skip to “How to Invest in Stocks with RM100”. Otherwise, I would suggest using that RM100 to invest in knowledge for stock investment.

The good news is, you can get most information for stock investment for free (but scattered).

Here are some of the financial channels or blogs that are relevant to Malaysians:

- Youtube channels: Mr Money TV, Millennial Finance, Ziet Invests

- Blogs: Dividend Magic, Mr-stingy, No Money Lah

- *Shameless plug* My blog articles or Marcus’s Money Tips series

I don’t read many books on stock investments. But if you like to read some good books, here are the books which I think are useful for building a foundation for stock investment:

p/s: You may also consider booking a 1-hour call with me to learn from me personally. Don’t worry, it does not cost more than RM100.

How to Invest in Stocks with RM100

In my opinion, a robo-advisor is the best tool for any beginners to start and feel how the stock investment works.

Why? Here are the reasons:

- You can start investing in it with only RM100 or less.

- Its registration process is quick and easy.

- It has great visuals, especially the investment value graph.

- It is simple to deposit/buy and withdraw/sell.

- It charges lower annual fees compared to unit trusts.

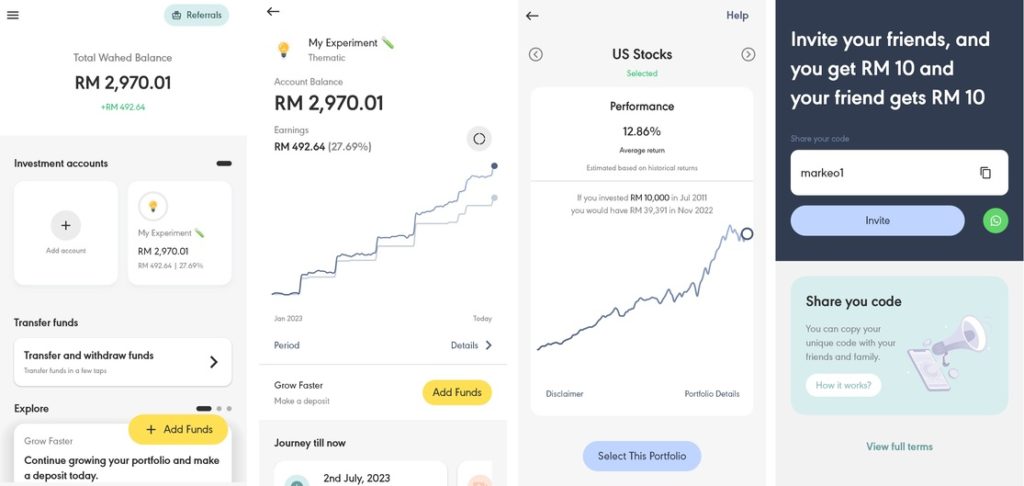

There are many robo-advisors in Malaysia, but these are the 2 robo-advisors that I’m using now:

- Wahed Invest

- StashAway

If you’re looking for Shariah-compliant investments, Wahed Invest is the best choice. It offers various portfolios based on your risk tolerance and preferences.

No idea what your risk tolerance is? No fret, it will suggest a portfolio that suits you based on your answers to its questionnaires.

Read more: Wahed Invest Portfolio Review

One thing that makes StashAway stand out is its flexible portfolios. You can customize your portfolio by choosing your desired ETF and its allocation.

Personally, I customize my portfolio with 99% of S&P 500 ETF and 1% cash (it is default, cannot be 0%).

But if you have no idea which ETF to invest in, similar to Wahed, StashAway will suggest you a portfolio based on the results of its questionnaires.

Read more: My StashAway Review

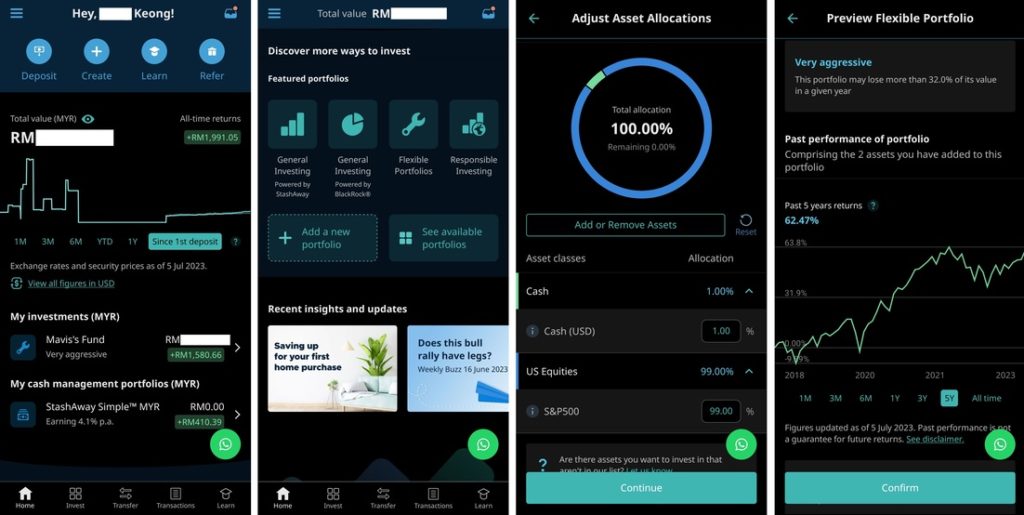

Wahed Invest vs StashAway

Here’s a quick comparison between these two robo-advisors:

In Summary

Image Source: Steemit

We are lucky to live in an era where we can easily start investing in stocks with little money.

In contrast, I wouldn’t suggest anyone start investing with a large amount of money. Losing 20% of RM100 is less painful than losing 20% of RM10,000.

I usually will recommend having these 3 things checked before you invest. If you have all the 3 things mentioned, your investing journey will be a lot smoother, thanks to your stable financial status.

That’s all for this week, my friend!

Talk with you again next week.

Your Money Buddy,

Marcus

Whenever you’re ready, there are 2 ways I can help you:

1) Book a 1-to-1 Call Session with me to pick my brain, whether it is about investing, money management, or any topic you’re interested to learn

2) If you’re not sure which platform to invest your money, here are 3 platforms that I personally use:

→ Rakuten Trade – Where I invest in US index fund ETFs. Get RM30 worth of RT points if you register & unlock foreign trading with my referral link.

→ Wahed Invest – Where I invest in Shariah-compliant US ETF. Get free RM10 if you register a new account with my referral code “markeo1”

→ Versa – Where I invest my emergency fund for a 4.3% return (up to RM30k). Get free RM10 if you register a new account with my referral code “AL9JZJ9H”