When I started working as a fresh graduate, I always loved saving money in Fixed Deposits. Compared with a 0.1% in a savings account, choosing an FD account with a 4% interest rate is undoubtedly a smarter choice.

Who wouldn’t want a guaranteed return that is 40 times better?

But now, a one-year FD only gives us a 1.85% return. This is less than half of what we have in previous years.

With such an unattractive return, I wanna share better alternatives to fixed deposits with you. They may give you equal or more than the FD rate but without the restriction of money being locked up.

Before that, let us briefly talk about the pros and cons of fixed deposits.

Disclosure:

This article contains affiliate links that may give me a small amount of commission with no additional cost to you (or some bonus to you) when you sign up through my links.

The Pros of Fixed Deposit

- Guaranteed Return

This is the main highlight of a fixed deposit. You wouldn’t find “guaranteed returns” from any investment. If you did, it is probably a scam.

But with fixed deposits, a guaranteed return is possible as your money is locked up in a certain period by banks. In exchange, they use your money for creating higher returns from personal loans or investments.

- Protected by PIDM

Most fixed deposits are insured by PIDM, automatically.

PIDM (Perbadanan Insurans Deposit Malaysia) is a Government agency that protects our deposits (such as fixed deposits) and insurance (such as Takaful insurance) in case the issuers (like banks) go bust.

By default, depositors get to enjoy the PIDM benefit up to RM250,000 without any fee or action taken, as the bank will pay for this protection.

- Higher Return than Savings Accounts

Banks give higher returns for fixed deposits compared to our saving accounts due to the condition of money being locked.

Theoretically speaking, they need to give higher return rates to attract customers to deposit their money into fixed deposits.

The Cons of Fixed Deposit

- Money is Locked for certain periods

The main drawback of fixed deposits is the locked-up mechanism. In exchange for higher returns, we need to place our money in the deposit for at least 1 month to 1 year.

- Penalty for Early Withdrawal

What makes the locked-up period worse is the penalty for early withdrawal. If you withdraw before the maturity date, you will not get any interest for your deposit.

- High Minimum Deposit

Some fixed deposits offer higher rates than the typical FD, but with a condition.

A minimum deposit of RM10K probably too much for some people.

But even in the typical FD, we need to deposit at least RM5K if we choose a 1-month FD.

The Better Alternatives

Since we understand more about fixed deposits, let me introduce you to alternatives that may be better than FD.

1) StashAway Simple

If you know about robo-advisor, then you probably heard of StashAway. Other than its investment portfolios, StashAway also provides a digital cash management platform known as StashAway Simple.

By investing in it, we get to enjoy a return higher than FD (up to 2.4% as stated on 2nd July). Unlike FD, we can deposit and withdraw money anytime from StashAway Simple.

Moreover, it allows us to deposit money as low as RM1, which is pretty amazing.

Here are other details about StashAway Simple:

- We can set recurring deposits into StashAway Simple.

- StashAway is regulated by Malaysian Security Commission (SC)

- The underlying fund behind StashAway Simple is AmIncome Fund, which is non-shariah compliant. (A new change made in 25 June 2021)

- We can schedule transfers between StashAway Simple and StashAway investment portfolios.

If you are interested to sign up for a StashAway account, feel free to use my referral link for FREE management fee up to 6 months.

2) Versa

Versa is another digital cash management platform that similar to StashAway Simple. Compared with StashAway, Versa is still new in the market. However, it managed to be licensed by Malaysian Security Commission (SC) and provides a similar return with StashAway Simple.

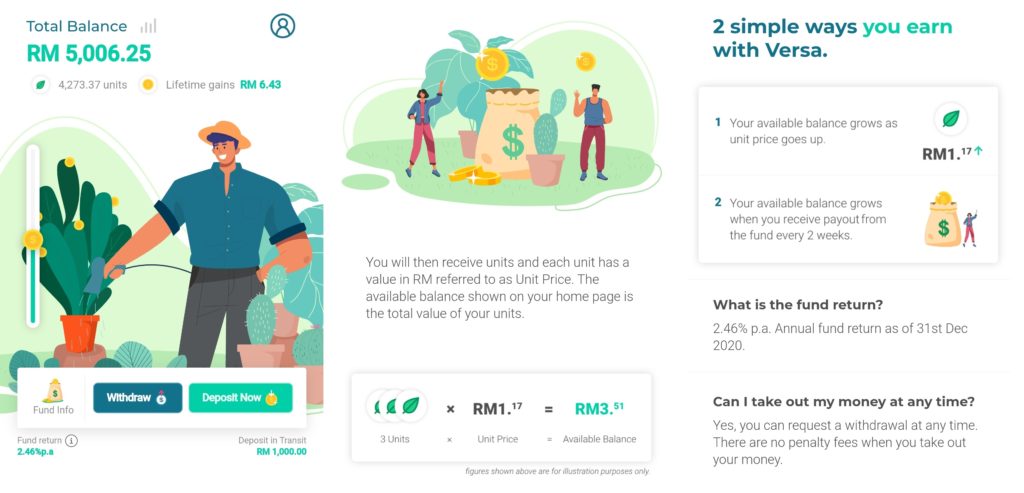

The reason why Versa and StashAway Simple able to obtain a higher return than FD is because they invest our money into Money Market Funds.

If you are new to Money Market Funds, here are some of the useful articles that you can read to understand more.

Since Versa only provides digital cash management services, it has more transparency and efficiency in its cash management. Other than being able to see our historical gains from our capital, it also takes shorter times to withdraw our money from Versa.

If you prefer to have a higher return and faster withdrawal for your money, you may want to give Versa a try.

Feel free to use my referral code “AL9JZJ9H” so you can get a bonus of RM100 when you deposited at least RM100 into your account.

Here are the quick steps to sign up for a Versa account:

- Download Versa app via Google Play, App Store or Huawei AppGallery.

- Launch the app and sign up with your name, email address and password.

- Key in my referral code “AL9JZJ9H” to get RM10 once deposited at least RM100.

- Complete your phone OTP verification, IC verification and other personal questions.

- Wait for 2-3 business days for Versa to verify your account.

To read more about Versa, check out their official website.

3) OCBC Frank

In my opinion, OCBC Frank is by far the best high-interest saving account I found in Malaysia.

Why is it the best?

If we can enjoy high interest without any strings attached, this is something worth considering. Of course, it will not be the best for you if you are looking for the highest interest rate.

Moreover, the OCBC Frank account offers an interest rate that is similar to FD return, without your money being locked up. With this kind of flexibility, it’s a no-brainer.

Here are details about OCBC Frank:

- 1.8% Interest (For money in save pot)

- No locked-up period

- No requirement needed to enjoy the interest

- An initial deposit of RM20 only

- Need to be a Malaysian citizen and 18 years old above

- Only individual account, joint account not allowed

Here are the quick steps to sign up for an OCBC Frank account:

- Download the OCBC Malaysia Mobile Banking app via Google Play or App Store.

- Launch the app and tap “FRANK SIGN UP” to sign up for the FRANK account.

- Follow the steps to sign up for FRANK.

- Verify your IC and go to the nearest OCBC branch to complete your account opening.

For more details, you may check out OCBC’s official website.

Which One Do I Prefer Over FD?

Personally, my choice will be Versa. Aside from having a higher return than typical FD, Versa’s 1-day withdrawal notice wins over StashAway Simple.

Not to mention that this app has a very attractive user interface. I also love the visual they provided for the historical gains from our idle cash.

I have been using it as my emergency fund tabung for more than a month now. So far I am satisfied with its return and user experience.

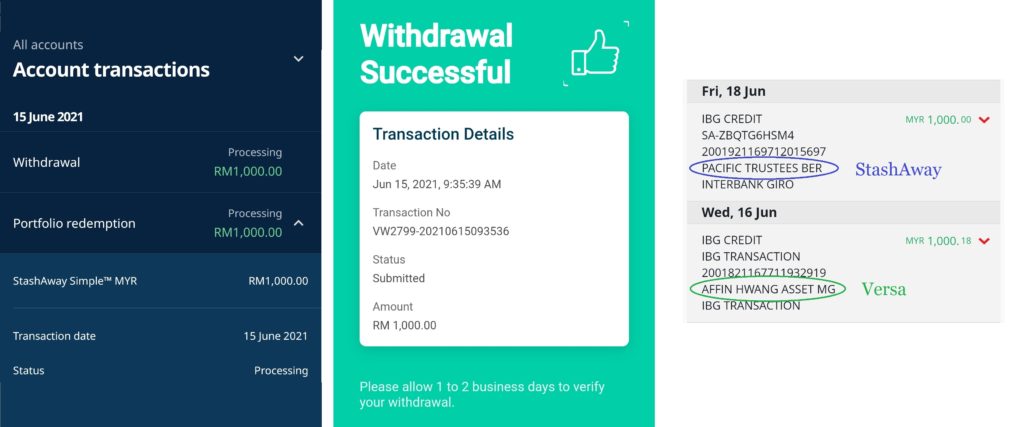

I have even tried withdrawing RM1K from both StashAway Simple and Versa at the same time. Guess what, I received the RM1K from Versa the next day. While the money from StashAway Simple took 3 days to reach my account.

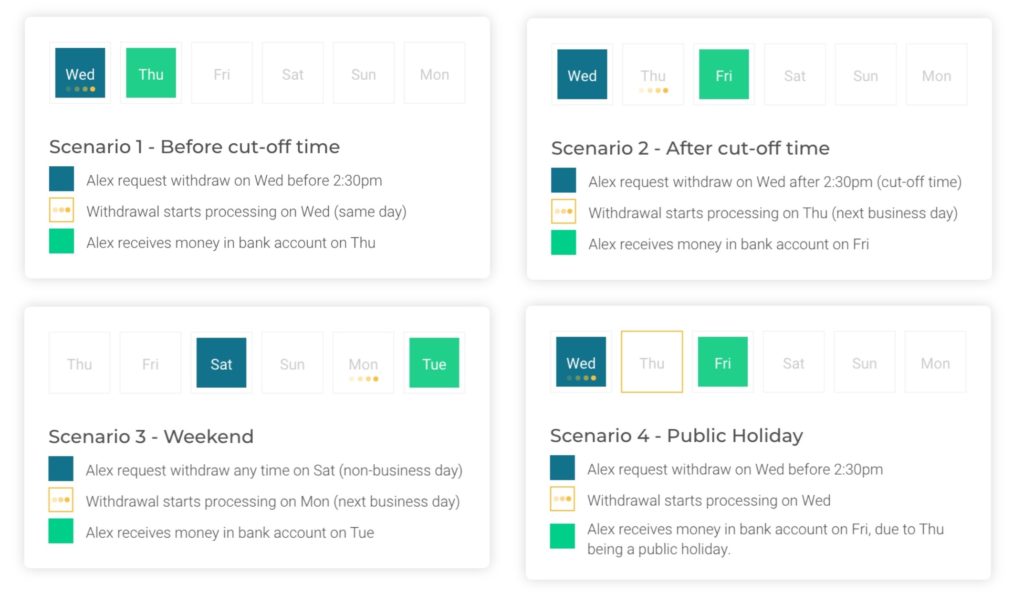

It seems to me that Versa knows their users well and understand they really care about withdrawal. So they provide different scenarios for the withdrawal process. This honestly made me trust them more.

Besides that, Versa provides some useful and informative articles for both beginners and intermediates. You can gain some money tips and financial knowledge while using the app.

The only bad thing about Versa is it is still new in the market. So you will see they are trying to get more exposure by partnering up with several influencers.

Speaking of partnerships, here I am again to share with you the exclusive referral code hehe!

Take this opportunity to register a Versa account and get free RM10 when you deposit RM100 with my referral code “AL9JZJ9H”. No harm taking that instant 10% return right?

Note:

Qualified users will receive the RM10 credit within 30 business days upon requirements are met.

Summary

Here is a summary table I compiled for all the alternatives and FD.

| StashAway Simple | Versa | OCBC Frank | Fixed Deposit | |

| Interest Rate (per annum) | 2.4% | 2.46% | 1.8% | 1.5% – 2.15% |

| Dividend Distribution | Monthly | Every 2 Weeks | Monthly | Depend on the locked-in period |

| Account Type | Digital Cash Management | Digital Cash Management | Savings Account | Fixed Deposit |

| Minimum Deposit | RM1 | RM1 (RM100 to get bonus RM10) | RM20 | RM1,000 – RM10,000 |

| Early Withdrawal Penalty | No | No | No | Yes |

| Withdrawal Duration | 3-4 business days | 1-2 business days | Instantly | Instantly |

| PIDM Protected | No | No | Yes | Yes |

| Other Remarks | – Recurring Deposit – Link with Robo-advisor | – RM10 referral bonus till 31st August 2021 | – Need to visit the nearest branch to complete the process | – Can be created via online banking |

The account opening process for StashAway and Versa will be relatively easier compared to OCBC Frank, which required us to visit the nearest OCBC branch. But if you prefer to withdraw your money within minutes, then OCBC Frank would be a better choice.

Nevertheless, to each their own. At least you have more choices to keep your money other than fixed deposits. I hope this article helps you to get better returns and flexibility for your sleeping cash.

Investment Risk Disclaimer:

Unlike deposit in financial institution, there are risks involved when you invest in money market funds. Please do your own due diligence before making any investment decisions.

For Versa and StashAway..

1) do we move money in and out via online banking?

2) how often are the dividend payouts? you mention per annum but i’m not really sure how that works (I’m totally new to investing). Let’s say I put in 100 today, in 1 year my total will show 102.40. Is that how it works?

Hi,

1) Yes, deposit and withdraw only via online banking.

2) For Versa, they will payout every 2 weeks. For StashAway, I’m not sure. But I read from other Youtubers saying it payout every month.

Thanks for asking this question. I should update my article with this.

Previously someone on insta shared a post regarding the return of versa and stashaway simple after 90 days,

I did a annualised return (to compare to FD), the actual return was way lower than the ” UP to 2.4% ” … it was around 1.4%-1.6% only.

Since u have deposited into both, maybe u can work out your actual annualised return to show the true return, instead of what was proposed by the app.

Hi KS. Sure, I will share their performance after some time.