As a tech nerdy, I always enjoy downloading new apps from Playstore. One day I downloaded an app called Money Race 2, and that is when I learned about dividends, passive income and financial freedom. It got me really curious to learn more about building my own dividends in real life.

Money Race 2 is a game that educates us on how to achieve financial freedom. It will show us tips, tricks, recommendations and common mistakes about money, personal finances and investments. We win the game when our passive income can fully cover our annual expenses.

Disclaimer: I am not sponsored by the app owner. I genuinely recommend this app to those who are new to personal finance because it teaches us how to achieve financial freedom in a fun way.

p/s: This article will be a long read. If you are ready, let’s cut to the chase and dive right in.

What are Dividends

When I just started to learn about stock investing, I always assume that dividends and bank interests are almost the same things. While we get interests from our money deposited in the savings account, we also get dividends from our money invested in the stocks.

Although they sound similar, dividends and bank interests have many differences. Here are a few things that make dividend different:

- The amount of dividend is not fixed.

- Dividends are not guaranteed returns.

- The frequency of dividend payments is not fixed (monthly or annually).

How Dividend Work

As an investor, we invest our money into a company so they can use that capital to expand their business and earn more profits. In return, the company may distribute a portion of the profits to its investors. That profit distribution is what we called dividends.

In order to learn about dividends in a more efficient way, I suggest you to download the KLSE Screener app. In fact, this is a must-have app for investors who want to invest in companies listed on Bursa Malaysia.

The Frequency of Dividend Paid in a Year

Each company pays dividends differently. Usually, we can find a company is paying dividends between one to four times per year. Some companies even go further to pay 5 times per year, depending on how generous they can be.

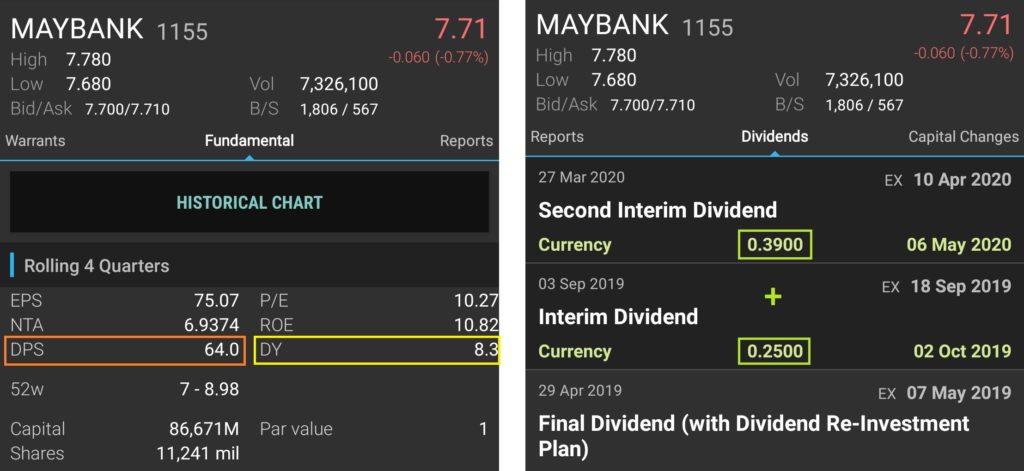

From KLSE Screener app, we can find the frequency of dividend paid by a company from the dividend tab.

Let’s take MAYBANK as an example. Key in MAYBANK in the browse tab in THE KLSE screener app. Check the stock by tapping on it and choose its dividend tab.

So we can observe that Maybank paid dividends twice a year. You can try this method to check out other stocks as well. (If you are new to the stock market, here are some stocks you can check out: PBBANK, CIMB, TENAGA, NESTLE, PETGAS)

Dividend is Not Compulsory

Please note that dividend distribution is optional for a listed company. Even when a company has been distributing consistent dividends in the past years, the company management can decide to change the frequency of dividend distribution or stop paying dividends in this year 2020 (probably due to Covid-19 pandemic).

Dividend is Not Free

In my early investing journey, I was naive to think that dividend is free money given by companies. So I come out with a plan that I will buy those stocks that are near to their dividend ex-date (cut-off date), then sell them afterward. Apparently, it is not as lucrative as I thought.

On the dividend ex-date (expired date), the stock price will be slashed by the total dividends given. For instance, if the share price is RM1 and the dividend for each share is 5 cents, the share price will be slashed into RM0.95 on its ex-date. This is pretty much how dividend works, so no one can take advantage of it.

The Timeline of Dividends

Announcement Date

When a company decides to distribute dividends, it will announce the good news through Bursa Malaysia. But due to the nature of the site, it will be very overwhelming to find one tiny announcement from the sea of stock information.

In this case, the KLSE Screener app comes in handy. We can find it under the dividend tab or the announcement section if there is any new dividend declared. This is the easiest way to check the dividend announcement so far.

Dividend Ex-Date

In an announcement of dividend distribution, we will also find a date known as the ex-date. This is the cut-off date that an investor is eligible to receive the dividend announced.

Here is a table showing how the ex-date works:

Refer to Figure 2, you can find the dividend ex-date at the top right corner of the dividend. As long as you are having the stock before the ex-date and hold it until the ex-date, you will receive the declared dividend.

Entitlement Date

This is the date when a company checks which investors are eligible to receive the announced dividend. Usually, it will be 1 or 2 days after the ex-date.

This date is not important for investors and hence does not shown in the dividend tab of KLSE Screener app. But if you are curious to know it, you can find this date in the announcement of the dividend by tapping on the dividend in KLSE Screener app.

Payment Date

This is a date when we received our dividends. If we have a direct account, the dividends will usually directly credited into our bank savings account linked to our brokerage account. If we have a nominee account (such as Rakuten Trade), the dividends will be credited into the CDS account with a delay of 2 to 3 business days.

The Value Traps

Dividends are the best passive incomes you can have if you are serious about earning money while you sleep. Ironically, you need to have prior knowledge on which stock is good to invest for its dividend.

As a new investor, we will often think that stocks with high dividend yield are the best dividend stocks out there. In reality, they might be traps. In the stock market, there are companies that intend to use dividends to lure investors into investing in them. This is what we call a value trap.

Before we talk about value traps, let us learn how to calculate the dividend yield of a stock.

Dividend Yield

In simple words, dividend yield (DY) is the dividend return rate of your shares. It can be calculated by taking the latest annual dividend per share (DPS) and divide it by the share price.

If you already own the share, the share price in the dividend yield formula will be your buying price. But if you do not have the share, then the current share price is used for the dividend yield formula.

Let us take an example to let you understand more about it.

If we are using the KLSE Screener app, we can easily find DPS and DY under the fundamental tab of a share in the KLSE Screener App. But as an investor, it is always better to know how to derives these figures ourselves.

To get the dividend per share, we just add up the dividend announced in a year. Today is in June 2020, so we add up RM0.39 and RM0.25 as our annual dividends, which is RM0.64 of DPS. (KLSE Screener measures DPS in cents)

To obtain the dividend yield of Maybank, we simply divide RM0.64 by the share price, which is RM7.71. You will get 0.083, which is 8.3% after converted to percentages. Oh, look at that! Our number is tally with the app.

Share Price vs Dividend Yield

Once we know how to calculate dividend yield, we will realize that dividend yield will change according to the share price.

Let us look at an example of how the share price will affect the dividend yield.

Bermaz Auto Bhd (BAUTO) is engaged in the distribution and retailing of Mazda vehicles. At their current share price of RM1.55, it has a dividend yield of 13.71%, which is extremely high compared to Malaysia’s average dividend yield of 4%.

Let us open up the share price history of BAUTO. We can observe that the share price has dropped significantly within one year. Imagine that we bought this share at RM2.50 in June 2019, the dividend yield should be around 8.5% only (21.25/250*100).

I have to admit that a dividend yield of 8.5% is still quite high. This is due to the company has always been very generous in giving dividends to its shareholders. The main point is we can see that a drop in share price will increase its dividend yield. In other words, share price and dividend yield are inversely proportional.

Identifying The Value Trap

If the dividend yield is too good to be true, then most probably you are right about that. While this share price looks like a bargain, we should also be cautious about the future prospect of this company.

Here are a few questions you can ask yourself when you found a good dividend yield stock?

- Is the dividend payout rational? (Payout Ratio not more than 0.8)

- Is its share price keep dropping? If yes, why?

- Is this company capable to give an equal or more dividend in the future?

- Will the company’s earnings continue to grow in the near future?

Payout Ratio

The payout ratio is a very useful financial ratio to check if a company pays dividends within its limit. DPS stands for Dividend Per Share while EPS stands for Earning Per Share.

As a benchmark, the company’s dividend payout is considered rational when its payout ratio is less than 0.8. In other words, a company should not give out more than 80% of its profits as dividends. A financially healthy company should have some good cash reserves to withstand bad times such as a pandemic.

Let’s take Bermaz Auto as an example again.

Although we can find the values of EPS and DPS in the fundamental tab, we cannot directly use them to calculate the payout ratio. This is due to the DPS is for 2019 financial year-end while EPS shows the sum of EPS for the latest 4 quarters. (If you directly use them in the formula, you will get a crazy payout ratio of 2.46)

Here is how we should calculate the correct payout ratio for Bermaz Auto.

At the reports tab, add up all 4 EPS from 2019 quarter reports to get the annual EPS. Then at the dividends tab, add up all the dividends distributed under 2019 year-end. (You can tap in to check its financial year-end showing 30 Apr 2019). We will get 22.86 cents of EPS and 21.25 cents of DPS.

By using the formula of the payout ratio, we will get a payout ratio of 0.93. This figure is considered a little over the limit compared with the benchmark of 0.8.

Dividend Yield is A Lagged Figure

After all these calculations, we will notice that the dividend yield does not represent the future dividend we will get. It is a value derived from the past dividends and the current share price. Hence it is important for us to understand the business nature of the company and how it sustains the earnings across the years.

In the case of Bermaz Auto, we can confirm that we will definitely not going to get a dividend per share (DPS) of 21.25 again when it’s earning per share (EPS) is only 8.64 in the year 2020.

If the company business is getting worse, then investors who bought the share with hope for the high dividend yield will be trapped. This is known as a value trap.

But if you have the confidence that the company business will recover in the near future, then its current price is quite a bargain. You will really get a 13% yield when the company earns enough to give 21.25 cents of dividends again. This is given that you can invest it for the long term.

For more info, you can read this article about value trap.

Criteria of Good Dividend Stocks

When we know how to identify value traps, it will be easier for us to filter off the bad apples and be only left with good apples.

Besides than having a good dividend yield, here are the criteria of a good dividend stock:

- Sustainable payout ratio

- Steady and growing earnings

- Consistent dividend payout history

- Positive free cash flow

Since we already talked about payout ratio before, I will skip the item 1 in this part.

Steady and Growing Earnings

The rule of thumb in stock investing is to always invest in the company that earns money. To verify that, we can check the history of the company earnings in the past 10 years. Other than looking back, we should also look forward to how the company is going to earn the same amount or more earnings in the future.

When the company earns more money, it may distribute more dividend for shareholders, which is the ideal case for dividend investors.

Consistent Dividend Payout History

When you are looking for a good dividend stock, don’t just look at the dividend in one year. We should track their dividend history in the past 10 years. If a company is not consistent in paying dividends, it might do the same thing in the future. You won’t want to invest in a company that suddenly stop giving dividends to you.

Positive Free Cash Flow

Free cash flow is the cash left over after a company pays for its operating expenses and capital expenditure. For your information, not all earnings are in the form of cash. Some of the earnings can be in the form of receivables, which are debts owed by the company’s customers.

The reason why free cash flow is important because a company requires cash to distribute dividends to the shareholders. If the company has negative free cash flow, it means there is more cash flowing out than cash flowing into the company. This is not a good sign for business as cash is always needed for employee wages, capital expenditure and dividends.

Summary

Dividend is not a magic. But when we understand how dividend works, it will be our best friend in our stock investing journey. Compared to capital gain, dividends replenish our war chest (cash reserve) to invest in more stocks. This is very useful especially during the market crash, which gives us a lot of buying opportunities.

Blog Update & Social Media

If you like this article, then you may like my other articles as well. If that so, feel free to subscribe to my newsletter so you can get the latest update from me when I posted a new article. 🙂

[mc4wp_form id=”236″]

Also, you can also get my new blog post updates by following my social media below. Don’t be shy and feel free to interact with me as well. See you there!

Hello again Marcus, I came back again today to reread this post. I like your detailed sharing on dividend investing. Keep sharing good and valuable stuff.

Hello Michelle. Thank you so much for dropping by. I really appreciate it and glad I can help. 🙂

Thank you, Marcus for the sharing.

I like the simple and straight-to-the-point illustrations.

Keep it up.

Hi Foh! You’re welcome. I’m glad it helps!

Hi Marcus,

Thank you of the valuable information about Dividend. Keep up the good work and shares more about trading skills!

Thanks Terence! 🙂