Hi! Here is where I share my stock portfolio which consists of individual stocks in Bursa Malaysia.

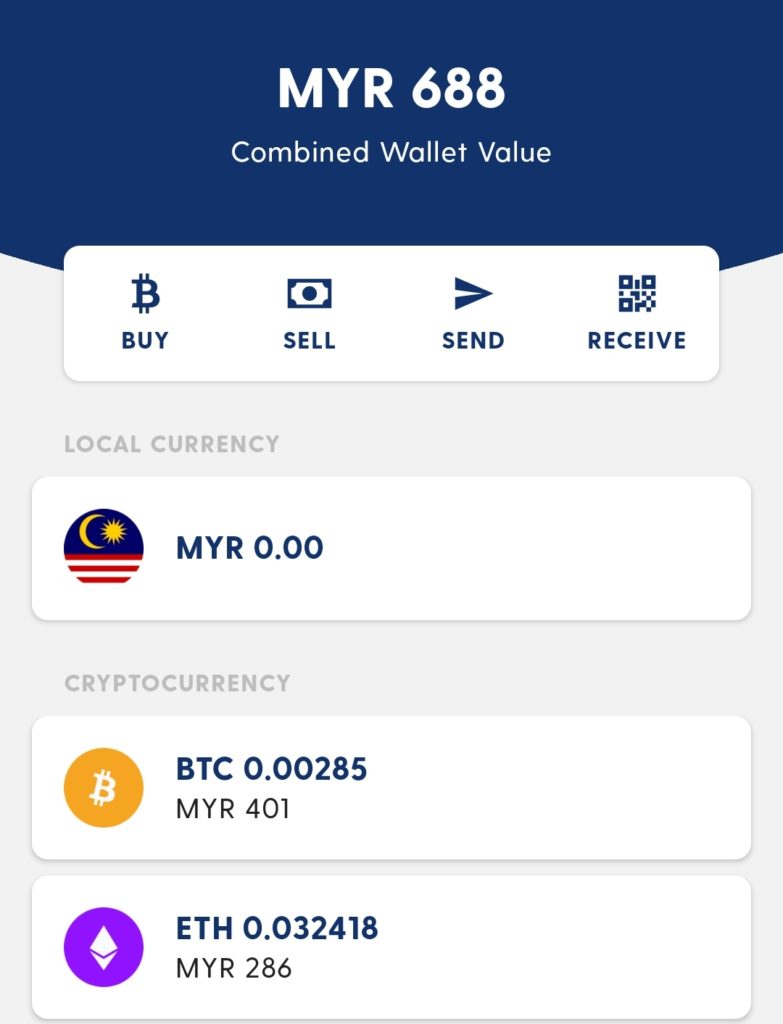

For your information, this portfolio is only a part of my investments. Apart from individual stocks, I also invest in robo-advisor, US ETFs, and cryptocurrencies.

Related Article: Marcus’s Crypto Portfolio Update

I will update my stock performance on monthly basis. If you want to be notified of my latest update, be sure to follow my Instagram or Twitter.

Disclaimer:

This content is meant for education and entertainment purposes. It is not a recommendation to buy or sell any stock. Please always do your own due diligence before making any investing decision.

About My Stock Portfolio

- I started this stock portfolio update in April 2021.

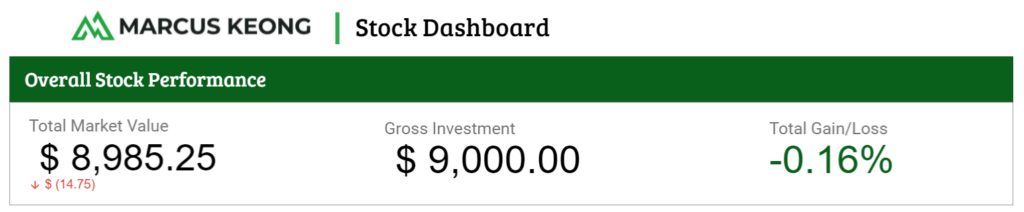

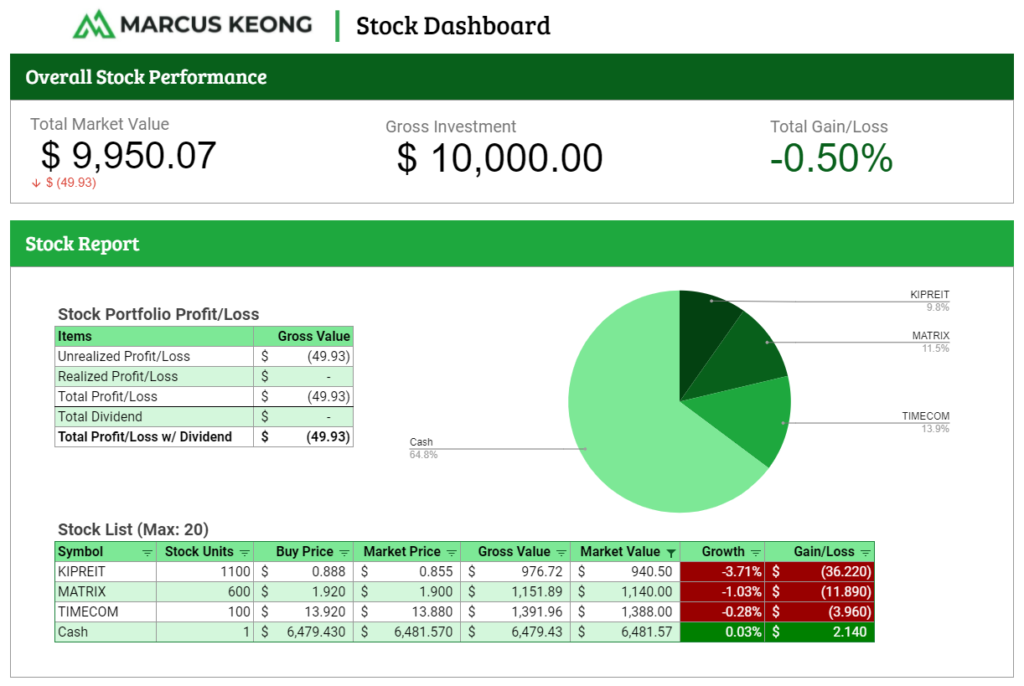

- My initial capital in this stock portfolio is RM10,000.

- I use Rakuten Trade as my brokerage account for this portfolio.

- My approach is to build a portfolio with companies that will consistently profitable for at least 10 years and above.

- My stock picks are a mixture of dividend, value, and growth stocks.

- I aim to have only 6-10 stocks in my portfolio.

The Brokerage Account I Use

I am using Rakuten Trade for all the transactions and stock holdings for this portfolio.

There are 3 reasons why I think Rakuten Trade is best for me:

- It provides historical realized profit/loss for my stocks.

- Stocks’ dividend are directly credited into my brokerage account.

- It’s app and website are user-friendly and easy to use compared with other brokerage account.

If you are interested to open an account, you may want to use my referral link to get 500 RT points (worth RM5) when you sign up for one.

Disclosure:

The affiliate link you use may give me some commissions (which are used to support this blog) with no additional cost to you.

2021 Monthly Portfolio Update

October 2021 Portfolio Update

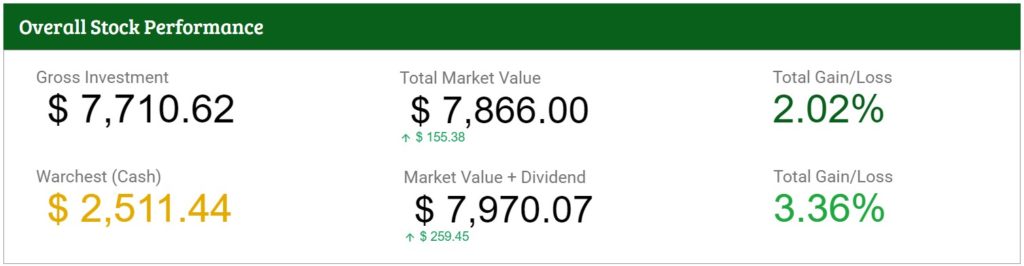

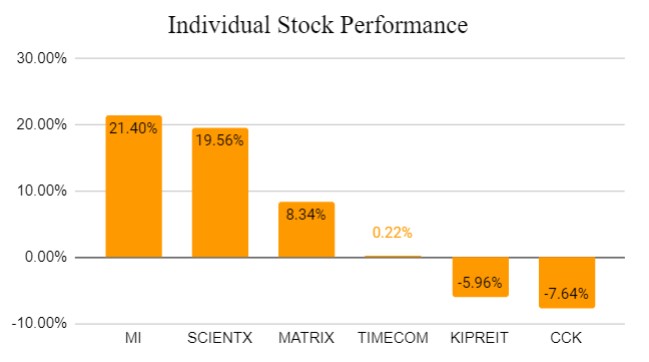

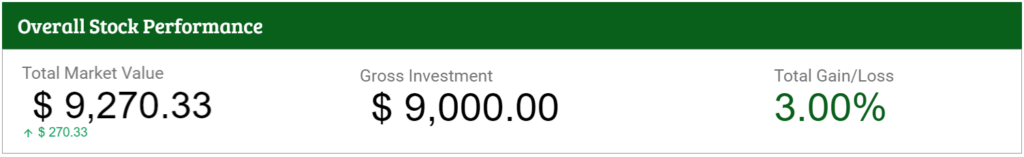

In October, my overall stock portfolio recovers its gain by 2.11% from September.

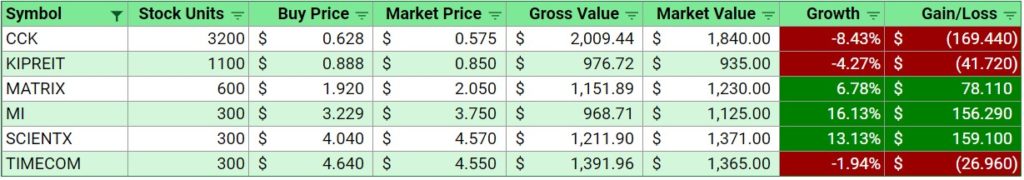

Currently, MI is still the top performer in my portfolio, while CCK is no longer the worst performer as its share price climbed to 60 cents.

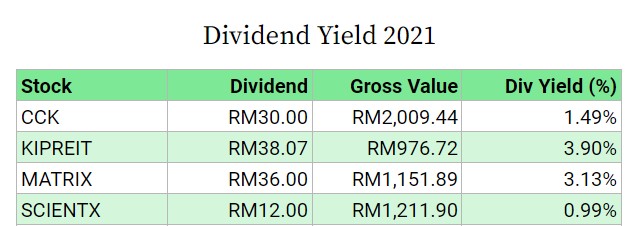

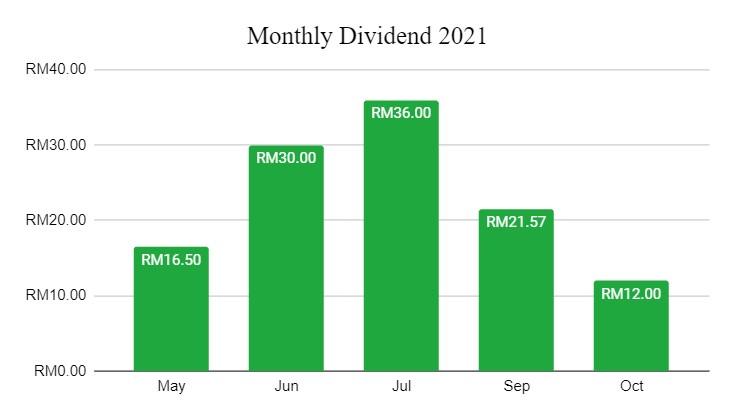

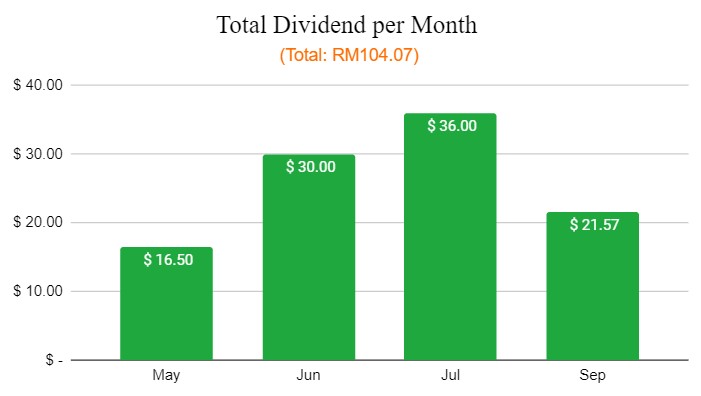

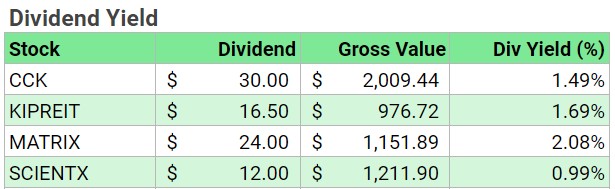

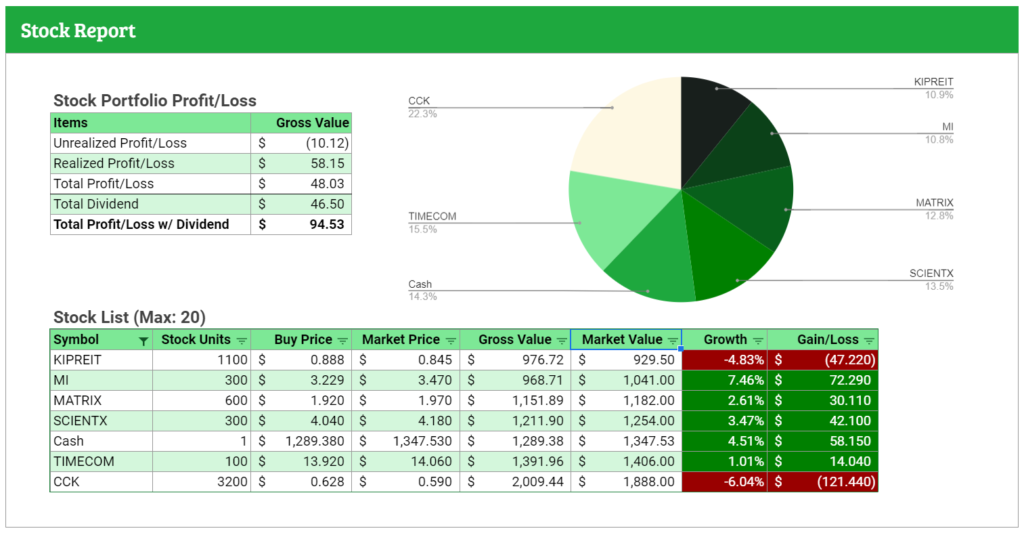

I also received dividends from Matrix worth RM12 (around 1.04% DY) in October.

In other words, Matrix is giving me a total gain of 15.12%, an unrealized gain of 11.99%, and realized gain (which is dividend) of 3.13%.

In October 2021, the total dividend I received from this portfolio is worth RM116.07.

Meanwhile, MI just released its quarterly result. Although its revenue and profits are lower compared with last quarter, its result is significantly higher than the previous year. The semiconductor business is still busy as always, so it is a matter of time that the revenue will materialize in the coming 2 years.

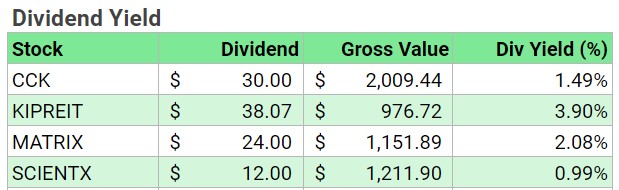

KIPREIT also announced its quarterly result and will distribute its income to shareholders next month. Though this quarter’s income distribution (1.55 cents) is lower than the previous quarter (2.1 cents).

September 2021 Portfolio Update

August 2021 Portfolio Update

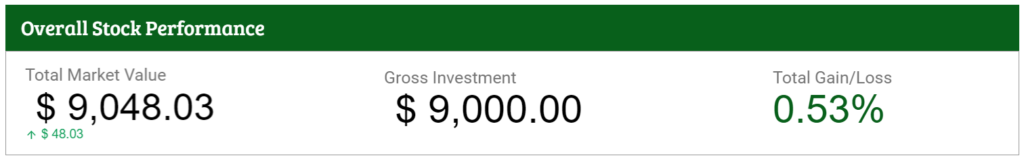

From August 2021 onward, I sold all my crypto for RM1,100 (10% gain!) which is part of this portfolio. I decided to 100% focus on Malaysian individual stocks with this fund.

Hence my cash has increased by RM1,100 compared to last month.

In September, I will create another page to update my crypto investment. Stay tuned!

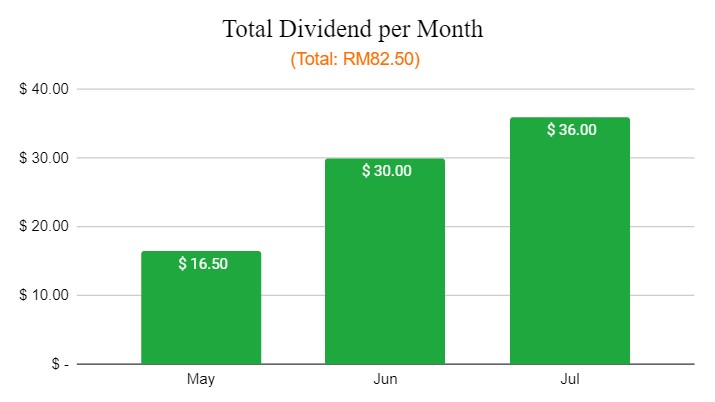

July 2021 Portfolio Update

June 2021 Portfolio Update

May 2021 Portfolio Update

April 2021 Portfolio Update

My Investing Approach

- I will invest in companies that I am comfortable holding for at least 10 years.

- Before buying a stock, I will ask these 3 questions:

1) What if the stock price drops more than 20%?

2) What if the company’s future performance is not as I expected?

3) What is my expected return after 10 years? - Only invest in companies with businesses that I truly understand.

- Never go all-in on a company. Instead, reserve some cash to average down if have the chance.

- Read at least one annual report of the company before I invest in it.

My Stock Portfolio Update FAQ

Q: Which sector are you looking good in?

A: Personally, I’m looking at sustainable sectors that provide necessities in life, such as consumer staples, communication services, and health care.

Q: Will you add more capital to it? Or just 10k?

A: I have decided not to increase its capital. However, I will still reinvest any dividend received from the stocks in this portfolio.

Q: Does this public portfolio mirror your main portfolio?

A: Yes.

Q: Are you favor more toward growth or dividend stocks?

A: Neither. If I find the company able to grow in revenue for the long term, then I will invest in it.

Q: Why does your cash have different gross value and market value?

A: That additional cash comes from dividends received and Rakuten Trade’s monthly interest.

Get Your Free Copy of Stock Dashboard

Interested to have my stock dashboard? I give it for free to my blog subscribers. So feel free to subscribe here.

[mc4wp_form id=”236″]

Note: When you get my dashboard link, please make a copy of it. Don’t email me to share edit permission with you. I won’t layan you.

Featured Image Credit: Anna Nekrashevich from Pexels