If you were a beginner in finance and want to learn how to start investing in Malaysia, there will always be this question pop out in your mind.

How can we invest with just little amount of money like RM1,000?

Then this question will eventually lead to another question. Save money or invest first?

First of all, there is no one size fits all answer for everyone as each of us comes from different background. Some are still very young with no debts, some already past 30 or 40 years old and realize that they should get their finance in order as soon as possible.

Before we go into details on 3 investments I recommend for you to start investing in Malaysia, here is one question for you.

Are You In Debt?

If you are a batman, of course you are not. To further explain it, debts are the money you owe others include student loans (such as PTPTN), house mortgage or even the money you owe your friends. But what I really want to discuss is those high-interest debts such as credit card debts, personal loans, or (maybe) car loans.

To make things clear, a loan with an interest rate of more than 5% is considered as high-interest debt. (If you do not have any debt, you can jump straight to the next section)

Why I use 5% as a benchmark for high-interest debt? It’s because that is considered a decent return from an investment (includes property investment) in Malaysia, compared to Fixed Deposit.

But Marcus, I thought we should “invest early”. That’s what many financial gurus told me to.

While I totally agree that it is best to start investing in Malaysia as early as possible, but that’s not the case when you are having high-interest debts. I will let the math explains to you.

If you start investing in Malaysia your RM1,000 in the Stock Market, and you have that beginner luck to obtain a super high 15% annual return. So the profit amount will be RM150. But then you have a credit card debt with an amount of let’s say RM1,000 also and it charges you an interest rate of 18%. Guess what happened to your hard-earned investment return? Imagine if that debt is more than just RM1,000. 😖

Paying Debt is an Investment Too

In reality, no one can guarantee that they will earn that much in the Stock Market every year. The only guarantee thing is the 18% interest earned by your credit card company. You are the customer that they love.

What if you pay off your credit card debts and avoid that 18% interest charge? Obviously, it is guaranteed that you save yourself from losing that 18%. In other words, this is equivalent to an 18% return from this payment. How awesome is that!

So what are you waiting for? List down all the loans you are having right now, along with their interest charge.

There is one effective method to pay your debts which I personally recommend. It is known as the Snowball Method. In case you want more tips to kill your debts, check out these 5 Extreme Ways For Malaysians To Pay Off Their Debt.

1) Invest in Yourself

One of the best advice from the famous investor, Warren Buffett is to invest in yourself. Before you jump into the investing journey, it is always wise to invest some money to empower yourself.

Here are some of the advantages of investing in yourself:

- Your money can be lost, but knowledge will stay with you forever.

- You become more competitive in your career and might get yourself a promotion.

- The flexibility of switching jobs and get higher pay.

- Improve your health and your life quality.

Wait, how come investing in yourself is related to health?

By definition, investing in yourself does not only mean learning new skills and knowledge. It also includes stress-relief, health and happiness as well, which in overall contributing to your long-term well-being.

A Short Story from Warren

Here is a story from Warren Buffett. Let’s say he is going to buy you a new car for free. You can pick any car you like, be it a Lamborghini or a Mustang, it’s your choice. Though there is a catch. That is the only car you will have for the rest of your life.

What are you going to do when you know it is the only car you will have and love?

You will take care of it, clean it everyday, polish it often. You will make sure it is going to be functional for the rest of your life.

In real life, yes you can have more than one car. But you will only have one body and one soul. So please take care of your physical and mental health, because you want them to last for a lifetime. If your health is on the edge, take that RM1,000 to have a medical checkup, eat healthy foods or sign up for gym membership to improve your health.

Learn About Stock Investing

Since I already have you aware of taking care of yourself, let’s talk about learning new skills or upgrading existing skills. If you are reading this blog for a while, you probably interested to learn how to invest in stocks.

For the past years, I have been learning about investing through the free resources available on the Internet. We are very lucky to born in an era where we can get access to all kinds of valuable knowledge in the palm of our hand (in another word, smartphone).

Here are a few comprehensive articles that I have read and helpful to me in stock investing:

- A Guide to Stock Investment in Malaysia

- How to Build Your Investment Portfolio (and How I Built Mine)

- The Ultimate Guide to 11 DIY Investment Options in Malaysia

- How to Invest in a Down Market? – 5 Malaysian Financial Experts Share Their Opinions

- Value Investing in Singapore – Your 2020 Guide

- Dividend Investing: The Ultimate Factor

Though some articles are written based in Singapore, the basics and examples help me a lot in establishing my investing knowledge. Nevertheless, I do believe that these resources might not enough for you to have the confidence to start investing in Malaysia. The truth is, stock investing is more than that.

To speed up your learning progress, it is wise to utilize your RM1,000 for a course or a class about investing. As I am a cheapskate who not willing to spend any money on investing courses, so I do not have any recommendations for you. Sorry buddy, it’s all up to you now.

Learn Skills That Increase Your Income

Aside from learning about stock investing, it is recommendable that you learn other skill sets as well. To have more returns from our investment, we need to increase our incomes so we can grow our capital to invest. Don’t you agree?

You can do 3 things to increase your earning power:

- Upgrade your skills needed in your main job.

- Learn new skills so you can make side incomes.

- Figure out how to monetize your current hobby.

You don’t have to do them all. Even one of them is enough as long as you are comfortable with it. In the end, it depends on how much you are willing to invest your time in upgrading yourself.

While it is a no-brainer to know which skills you should upgrade for your career, but what about the new skills that you can make side incomes? How to monetize your hobby? Here are a few articles that might give you some insights:

- 31 Side Income Ideas You Can Start in Malaysia (Updated 2020)

- Make money doing what you love: 5 hobbies you can monetize

- 13 Proven Ways to Monetize Your Hobby

Align Them With Your Long Term Goals

While learning things you like, you need to figure out what is your long-term life goal. If you are learning too many things and you are still getting nowhere, that’s mean you have no idea what is your destination. We don’t want to be the jack of all trades, master of none.

Let’s take me as an example. Other than finance and investing, I also want to learn about cooking, writing, playing guitar, editing videos, learning Japanese and photography. Do I need to learn all that? Definitely no. It’s too overwhelming to learn them all.

My long term goal is to create values and share knowledge for others to learn how to invest and manage their money. With that goal in mind, I will only choose to invest myself in learning writing, video editing and maybe photography.

So to invest in yourself, write down your long term goal first. Then use it as a guidance to know what skills you should be learning.

Why Paid For It When We Can Learn For Free

Although we have many free resources available online to learn these skills, there are a lot of advantages from attending paid courses or classes with your RM1,000 (Given that they have the quality in their lessons):

- Speed up your learning progress with specific knowledge and skills. (Free resources on the Internet are usually scattered)

- Obtain real-time feedback from your tutor (unless you bought an online course).

- Make friends with like-minded people who are serious about learning.

- Motivate you more in learning the skills when you are surrounded by like-minded people.

So don’t be stingy like me okay? Before you are being skeptical of these paid courses, consider the benefits I mentioned above. It might be more beneficial than you think.

2) Invest in REIT

Real Estate Investment Trust, also known as REIT, is a public listed corporation that acquires and makes profits from real estate or properties. Similar to company share, REIT can be bought in the public market via Bursa Malaysia.

But why invest in REIT?

Similar as Property Investing

REIT is a simple business that even your parents can understand. Like property investment, a REIT earned profits by collecting rentals from real estate and properties under its management. The only difference is you have a team of managers to help you collect your rentals.

Low Capital To Start

Unlike physical property, you don’t have to fork out tens of thousands to invest in REIT. Personally I invest in KIP REIT, which manages several KIP malls in Malaysia. You will be familiar with it if you are living in southern East Malaysia. So let us look at its current share price.

With just RM0.77, you can buy at least 1,200 unit of its shares with RM1,000. Let us look at another example of REIT. We will choose the most expensive REIT in Malaysia.

KLCC costs RM7.84 per share on my writing date. Even with its highest price of RM8.40 per share, you can still buy 100 units of it with just RM1,000. You may check out the real-time updated price of all the REIT in Malaysia by Fifth Person.

You will be surprised at how familiar you will feel to some of the public listed REIT in Malaysia even without any experience in the Stock Market. They are usually those famous malls such as Mid Valley, KLCC, Sunway Pyramid, and Pavilion.

Profit Distribution Policy

To enjoy the corporate tax exemption (24%), the public listed REIT has to distribute at least 90% of its net profit to shareholders. It will not be sensible for REIT management to opt-out from this policy and get heavily taxed.

With this, we shareholders can take the advantage to invest in them and receive consistent and guaranteed income distribution from REIT.

Less Price Volatility

To start investing in Malaysia, it is good to start with something less nerve-wracking. You don’t want to invest in a stock that suddenly up 5% the next day and drop 20% in one week. Trust me, your heart cannot take it.

Based on historical price, REIT is proven to be a less volatile choice of stocks to invest. Despite that, please be reminded that REIT is still exposed to market risk especially this year 2020.

If you want to understand more about REIT, you can read these articles

3) Invest in Robo-Advisor

Initially, the third investment that comes to my mind should be “Invest in ETF”. But our Malaysian ETFs’ performance is still not as good as what we see in the US. Moreover, there are always a lot of questions regarding how a Malaysian can invest in US ETF such as the S&P 500. (By the way, ETF stands for Exchange Traded Fund)

Hence robo-advisor is a better alternative for ETF, at least for Malaysians. Before we go deep into it, let’s briefly go through what is robo-advisor.

Artificial Intelligence That Help You to Invest

Do you have any friends who are bankers? Or your parents’ friends who are bankers? If yes, you must be familiar with “unit trust”, which they keep introducing you to invest in.

Basically, a unit trust is a huge fund that actively managed by a group of fund managers. This fund comes from customers like you, and these fund managers help you all to invest in the market. In return, they charge you with a percentage of management fees, regardless there is profit or not.

Now, what will happen when we replace this group of fund managers with a well programmed artificial intelligence (AI)? A robo-advisor, yes.

There are currently 3 robo-advisors that are available in Malaysia till date:

Literally, you let a robot to help you manage your capital. In this era, AI has started to gain trust from we human race that we decide to let them help us invest our money. Hopefully, the trust we gave them will not turn into an invasion.

Wait? Why should I invest robo-advisor? And what its relation to ETF?

Passive Investing

By investing in a robo-advisor, you save the hassle of constantly managing your investment. This is the best way to invest your money if you don’t like to spend time learning all the nitty-gritty about investing. Let AI do the job for you like a boss.

Eh Marcus, invest in a Unit Trust also a passive investment what! Why should I trust a robot?

Well, here’s the next reason to invest in robo-advisor.

Low Management Fee

Remember that I mentioned there will be management fee charged by the fund managers from your unit trust? Robo-advisor has the fee as well, but with a rate that definitely a lot lower than unit trust.

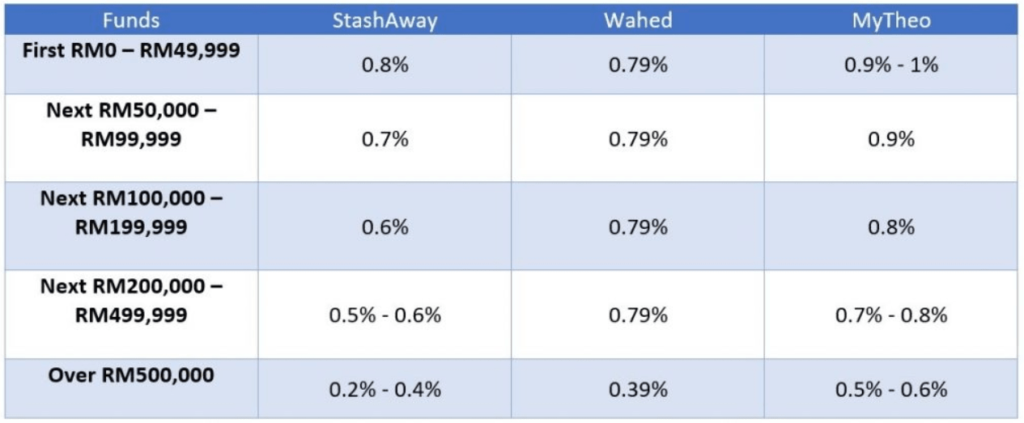

Here is a table of management fee charged by 3 robo-advisor in Malaysia:

Can your unit trust agents charge you below this fee? They will live at the longkang side and eat grass if they charge this low. (Okay I just exaggerate it, the income should not be so teruk lah)

Diversification in Different Assets

Still remember why I said Robo-advisor is an alternative for ETF? It’s because Robo-advisors will help you to invest most of your money in ETF across the US and other international markets.

Here is the ETF portfolio chosen by the 3 Robo-advisors in Malaysia:

Why these Robo-advisors love to invest in ETFs? It is because ETF is an asset class that tracks an underlying index of selected top companies. By investing in ETF, your fund is automatically diversified to the selected companies tracked by the ETF.

The Downside of Robo-advisor

Even though AI has no emotion (which is a good thing in investing), people will always be skeptical about its performance. Moreover, we cannot control the asset allocation of our fund when we invest in a Robo-advisor. If you prefer to invest in your preferred stock or ETF, then Robo-advisor may not be a suitable investment platform for you.

But if you are that busy person who does not have much time to learn about investing, you should consider investing in a Robo-advisor. Compared to a unit trust, it is cost-efficient and emotionless.

Out of these 3 Robo-advisors, personally I have chosen Stashaway to invest some of my money passively. If you are keen to register an account in Stashaway, feel free to use my referral code to get up to RM30,000 managed for free for 6 months.

Read More: My StashAway Review: A Robo-Advisor That Invest For You

Conclusion

Let us summarized all the 3 investments which I recommend.

- Invest in Yourself: Build a foundation and upgrade your skillset.

- Invest in REIT: A safer investment for beginners to get into the Stock Market.

- Invest in Robo-advisor: A good choice for passive investing and diversification.

I hope this article will bring you some insights and help you to start investing in Malaysia. It is okay to take your time to study and explore rather than rushing it.

After all, investing toward financial independence will be a long journey in your life. So you should make sure you are well equipped with decent weapons and armors before you start your investing adventure in Malaysia.

I wish you best of luck in your investing journey.

Want to have more investment options to start investing in Malaysia? You can check out Ringgit oh Ringgit article for more ideas on how to invest your RM1,000.

Blog Update & Social Media

If you like this article, then you may like my other articles as well. If so, feel free to subscribe to my newsletter so you can get the latest update from me when I posted a new article. 🙂

[mc4wp_form id=”236″]

Also, you can also get my new blog post updates by following my social media below. Don’t be shy and feel free to interact with me as well. See you there!

Hi. I would like to ask about the StashAway. Im new to this investing and I dont have any debt. However, I dont have rm1000 to invest even though im targeting on investing in s&p500. Can I still use StashAway to invest with less than rm1000. Is it the same for Rakuten Trade? Hope to hear from you soon. Thanks.

Hi May. Yes you can use StashAway to invest in S&P500 via its flexible portfolio.

RM1,000 is just a figure, but you don’t have to wait until you have RM1k to start investing.

So don’t worry about it.

Is it the same for Rakuten Trade?

No, it’s not.

Rakuten Trade needs to buy at least 1 lot (100 units) shares in Bursa Malaysia, and 1 unit of share in US market.

So it depends on the price of the share whether you can buy a share with less than RM1000.

Hi,

Thanks for the info on REIT.

Is this a good time to invest in REIT, when its price per share is low?

Hi! Can’t give you any recommendation.

You have to calculate your own fair value of the REIT, then only you know if the price is low enough to invest in.